May U.S. cutting tool orders totaled $214.4M, up 4% YTD over 2023

May U.S. cutting tool orders totaled $214.4M, up 4% YTD over 2023

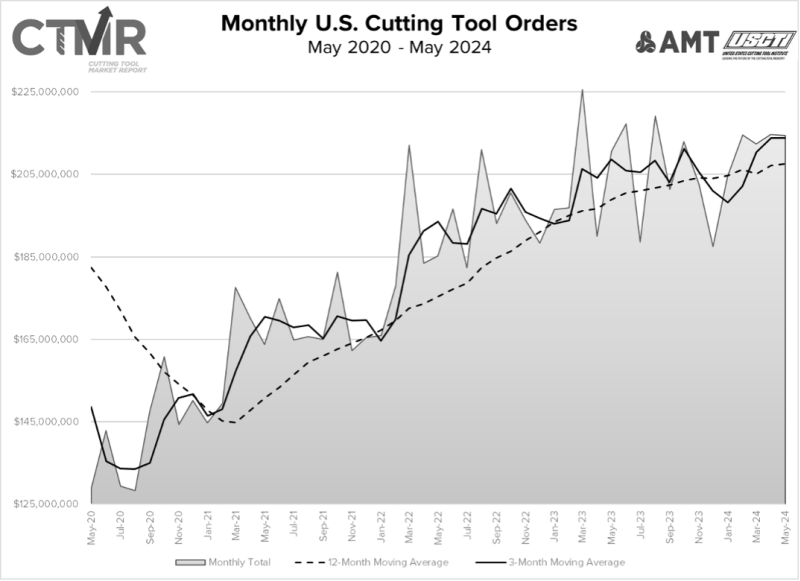

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), were $214.4 million in May 2024.

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), were $214.4 million in May 2024.

Orders decreased 0.1% from April 2024 but grew by 1.8% over May 2023. Year-to-date shipments totaled $1.06 billion, up 4% from shipments made in the first five months of 2023.

"May's results indicate that production levels remain strong, but I think the historically high numbers can be somewhat attributed to inflation," said Jack Burley, chairman of AMT's Cutting Tool Product Group. "Backlogs are coming down, and most job shops are no longer working overtime, but they're still dependent on the core customer base they support. A side benefit is that shops now have time to test new products and work on process improvements rather than focusing on hitting their shipments every week."

Alan Richter, editor-at-large of Cutting Tool Engineering, noted: "Through May 2024, shipments of cutting tools continued to show a slight increase in the year-to-date percentage. However, the near-flat growth in recent months is partly due to the challenges faced by aerospace and defense manufacturers. Like most manufacturers, they have needed to overcome supply chain snags, longer lead times, and a shortage of skilled workers, even while demand for their products is relatively strong as geopolitical instability unfortunately grows and the demand for global air travel climbs."

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers' consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.