September cutting tool orders up 14.7% compared to August

September cutting tool orders up 14.7% compared to August

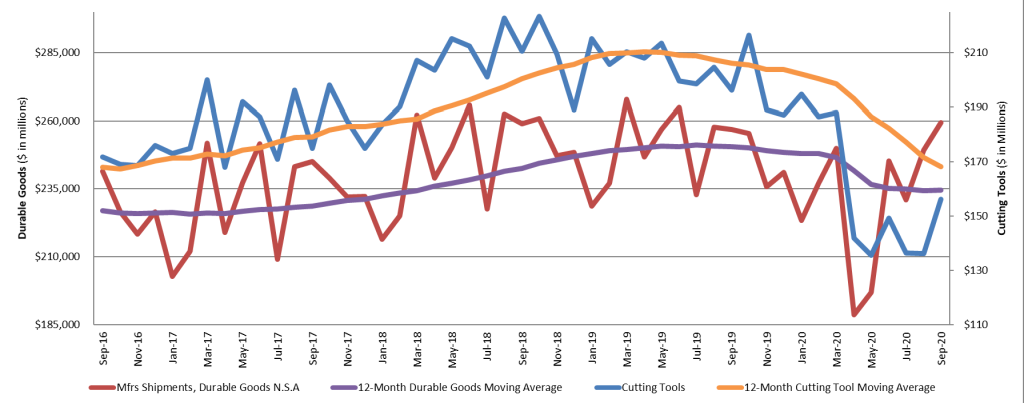

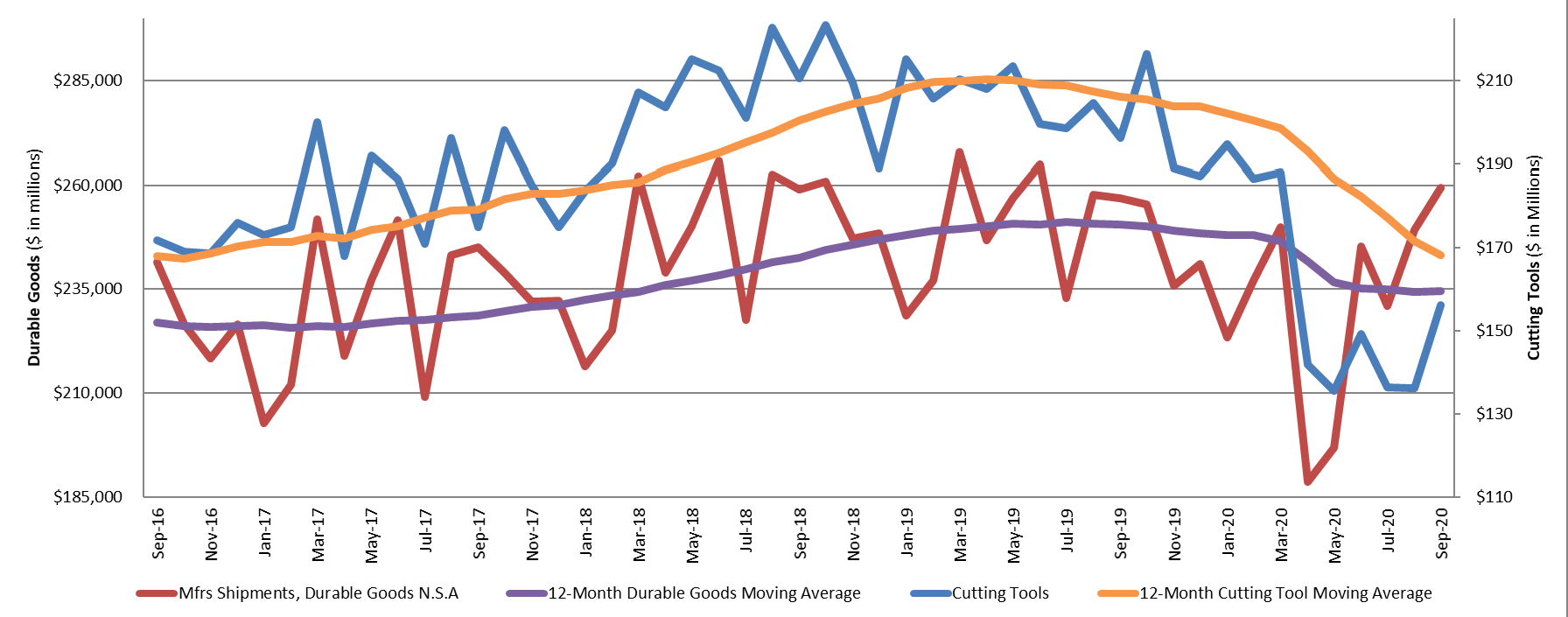

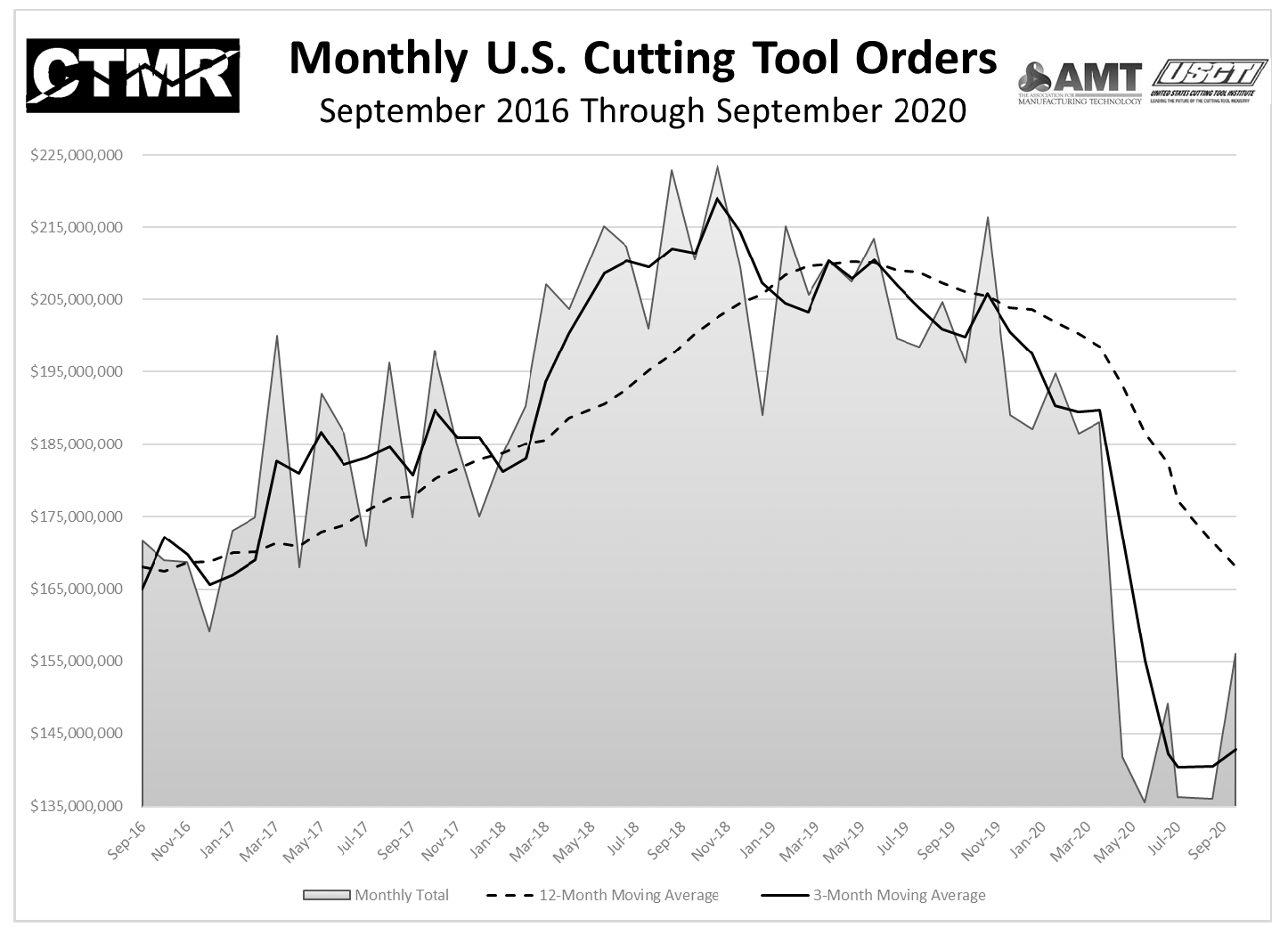

September 2020 U.S. cutting tool consumption totaled $156.1 million. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 14.7 percent from August's $136.1 million and down 20.5 percent when compared with the $196.3 million reported for September 2019.

September 2020 U.S. cutting tool consumption totaled $156.1 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association for Manufacturing Technology.

September 2020 U.S. cutting tool consumption totaled $156.1 million, according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association for Manufacturing Technology.

This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was up 14.7 percent from August's $136.1 million and down 20.5 percent when compared with the $196.3 million reported for September 2019. With a year-to-date total of $1.4 billion, 2020 is down 23.1 percent when compared with September 2019.

down 23.1 percent when compared with September 2019.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

Brad Lawton, chairman of AMT's Cutting Tool Product Group, "… we have seen an improvement of sales numbers, which is a whisper to reduce the uncertainty from the 2020 year of trauma. The cutting tool industry will recover, but we all know it will take time and we must be patient. Stay focused and we will see the numbers continue to improve."

Chris Kaiser, president and CEO of Big Kaiser Precision Tooling, said that year-over-year and year-to-date percentages seem to be correcting in the right direction as of September 2020. "Back in April, the 'doom and gloom' forecast showed the year ending down 40% and fortunately that does not seem to be the case. Many of us in the cutting tool industry also watch the machine tool orders and those numbers improved in the recent month as well. At this point we are optimistic about the fourth quarter. We are not counting on a large Christmas present but just looking for some steadiness in the market and no further shutdowns."

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers' consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.