Servo motors and drives sales benefit from rising factory automation

Servo motors and drives sales benefit from rising factory automation

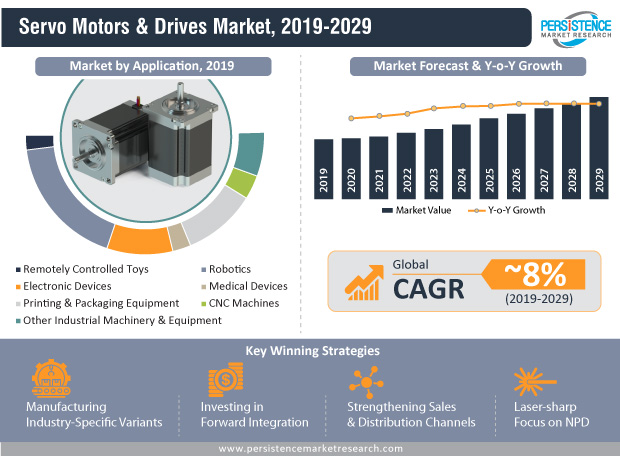

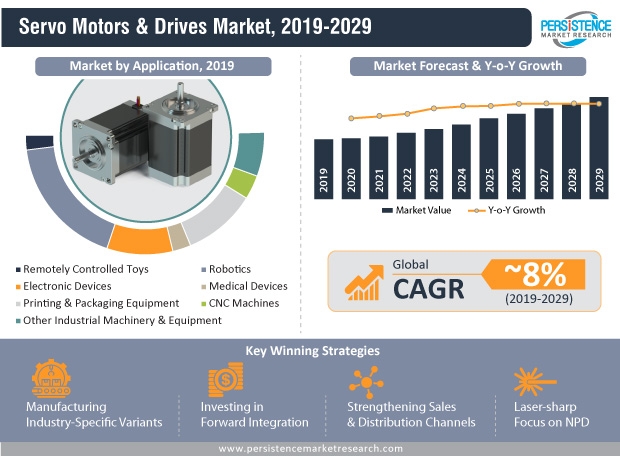

The global servo motors and drives market was valued at about US$ 9 Bn in 2014, and is expected to surpass US$ 12 Bn by the end of 2019. The servo motors and drives market is expected to grow at a CAGR of about 8% between 2019 and 2029, and is estimated to reach a global value of about US$ 28 Bn by the end of 2029.

Article from Persistence Market Research

The global servo motors and drives market was valued at about US$ 9 Bn in 2014, and is expected to surpass US$ 12 Bn by the end of 2019. The servo motors and drives market is expected to grow at a CAGR of about 8% between 2019 and 2029, and is estimated to reach a global value of about US$ 28 Bn by the end of 2029.

A new market study on the servo motors and drives market, which includes the global industry analysis 2014–2018 and forecast 2019–2029. The report studies the global servo motors and drives market and offers an in-depth analysis for the next 10 years. The report on the global servo motors and drives market contains vital macroeconomic and forecast factors that are estimated to drive the growth of the global servo motors and drives market. The report on the servo motors and drives market also discusses restraints that are expected to hamper the global market, along with potential opportunities and latest trends in the market across the value chain.

Servo Motors and Drives Witnessing Lucrative Opportunities in Non-traditional Application Areas

By application, the robotics segment is likely to hold a significant share across the globe due to the unprecedented developments in the robotics industry and heavy adoption of robotic techniques in various end-use industries. The printing and packaging equipment segment will also show a decent share hold over the market and is set to register a healthy growth over the forecast period. Moreover, in food and beverages industry, servo motors and drives are playing a vital role to make accurate packages of foods or cold drinks. Thus, servo motors and drives application is not limited to the above mentioned industry but also these motors are gaining healthy traction in other industries such as pulp and paper, and textile.

By technology, the servo motors and drives market is segmented into single-axis servo systems and multiple-axis servo systems, among which, the single-axis servo systems segment is expected to attract end users and is likely to witness more traction in the servo motors and drives market. The reasonable cost and efficient performance of single-axis servo systems is likely to play a pivotal role for the substantial growth in the market of single-axis servo systems.

By product type, the global servo motors and drives market is segmented into linear servo motors and rotary servo motors, and both the segments are projected to have near about equal sales with linear servo motors gaining a slight edge in terms of market share. Linear servo motors are manufactured by several manufacturers, which provides customer liberty to choose a product best fit for their purpose. Due to this scenario in the market, linear servo motors have a slightly more sales across the global market. Moreover, linear servo motors and drives are used for repetitive operations such as assembly and arrangement on XY tables, and CNC machines.

AC Servo Motors and Drives Account for 75% of Total Sales

By motor configuration, the global servo motors and drives market is segmented into AC servo motors and DC servo motors and to provide a more specific outlook AC servo motors and drives are further categorized into industrial type and asynchronous type. On the other hand, DC servo motors are categorized into brushless DC motors, separately excited DC motors and permanent magnet DC motor. On the global perspective, AC servo motors are more likely to be preferred in the market due to its ability to operate with the AC current as well as it also pick up frequently light load and heavy load. Almost 75% of the market is estimated to be held by the AC servo motors and drives across the globe. Meanwhile, synchronous type AC motors are going to be the top choice of customers among other offerings of servomotors. In the DC servo motors and drives market, all the three sub-segments are expected to attract the target customers in the market.

By rated power capacity, the global servo motors and drives market is segmented into 400 – 750 W, 750 W – 1 kW, 1 - 5 kW, 5 – 15 kW, 15 – 50 kW, and 50 – 100 kW. The demand for these products depend on the requirement of end users. Although, the servo motors and drives 750 - 1Kw segment is expected to remain paramount share holder in the market over the forecast period. However, the demand for servo motors and drives entirely depends upon its requirement and applications.

By region, the servo motors and drives market has been segmented into six regions, namely North America, Latin America, Europe, East Asia, South Asia, and Middle East and Africa. In these regions, The Europe market is estimated to grow with a noteworthy share in the global servo motors and drives market over the stipulated time period. However, East Asia and South Asia regions are estimated to grow with significant collective share throughout the forecast period. Moreover, the North America region is expected to account nearly 10% share in the global servo motors and drives market owing to the rising awareness of end user towards accuracy and precision, coupled with the factory automation.

Competition Analysis

The global servo motors and drives market is characterized as a fragmented market, owing to the significant presence of well-established and small scale manufacturers of servo motors and drives across the globe. For profound analysis, Study has analyzed the global market in three categories: Tier 1, Tier 2 and Tier 3. Here, Tier 1 players are estimated to account for large share in the global market. Furthermore, increasing number of full-fledged companies mainly from emerging regions such as in China, are making competitive structure in the global servo motors and drives market.

Moreover, renowned players in the global market are adopting business expansions, acquisitions, collaborations, and product launch strategies, in a bid to promote substantial growth to the servomotors and drivers market.

- In April 2019, Siemens AG launched an enclosed IEC motor for industrial and construction application, which highlighted the product innovation performance of the company.

- In June 2019, Mitsubishi Electric Corp. inaugurated its new office in Boston to improve its presence in the market of North America.

Some of the key players identified across the value chain of the global servo motors and drives market includes Siemens AG, Panasonic Corp., Parker Hannifin Corp., Nidec Motor Corp., Delta Electronics Inc., Fuji Electric Co. Ltd., Hitachi Industrial Equipment Systems Co. Ltd., Mitsubishi Electric Corp., Schneider Electric, Rockwell Automation Inc., ABB, Applied Motion Products Inc. and Altra Industrial Motion Corp.