Manufacturing industry growth projected to slow in 2019

Manufacturing industry growth projected to slow in 2019

Economic experts say that growth will rise but less briskly than it did this year.n

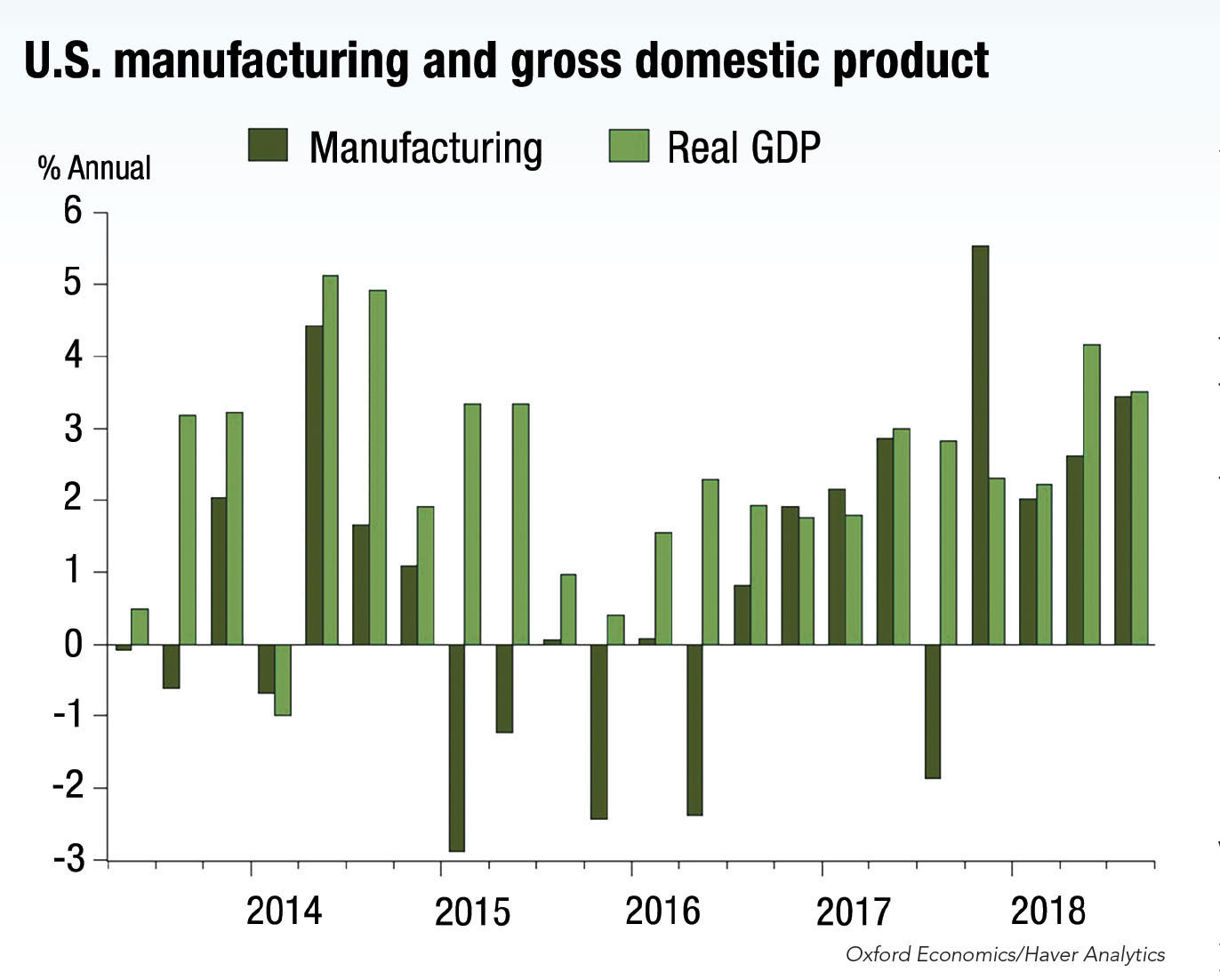

When looking at the data, the U.S. manufacturing industry is doing quite well.

For example, the latest data through September shows that manufacturing was up 3.5 percent year over year, the strongest pace since early 2012, noted Gregory Daco, chief U.S. economist for Oxford Economics USA Inc., New York City. "That's helping industrial production overall grow at the fastest pace it's grown since 2010, at 5.1 percent year over year."

Daco added that solid growth is occurring despite the rising trade tensions between the U.S. and China—and essentially between the U.S. and the rest of the world. Those tensions include implementation of tariffs on a large quantity of imported steel and aluminum, as well as Chinese-produced goods.

Nonetheless, growth in U.S. manufacturing continues, he said, because the industry experienced strong momentum before the end of 2017, there's solid domestic demand and relatively high confidence and U.S. energy activity is on the rise. "Then that was complemented by the advent of the Tax Cuts and Jobs Act, which added further impetus into the manufacturing sector with reduced tax valuations for manufacturers and increased capital depreciation allowances."

However, Daco expects those tailwinds to weaken in 2019 as the marginal impact from the tax stimulus dissipates over time. What isn't expected to dissipate in the near term is the atmosphere of rising trade tensions, likely resulting in higher prices and higher interest rates that constrain margins and borrowing on the manufacturing front. "I wouldn't be surprised to start seeing some moderation in the pace of manufacturing activity," he said, emphasizing that slower economic momentum does not equate to a recession.

Forward Thrust

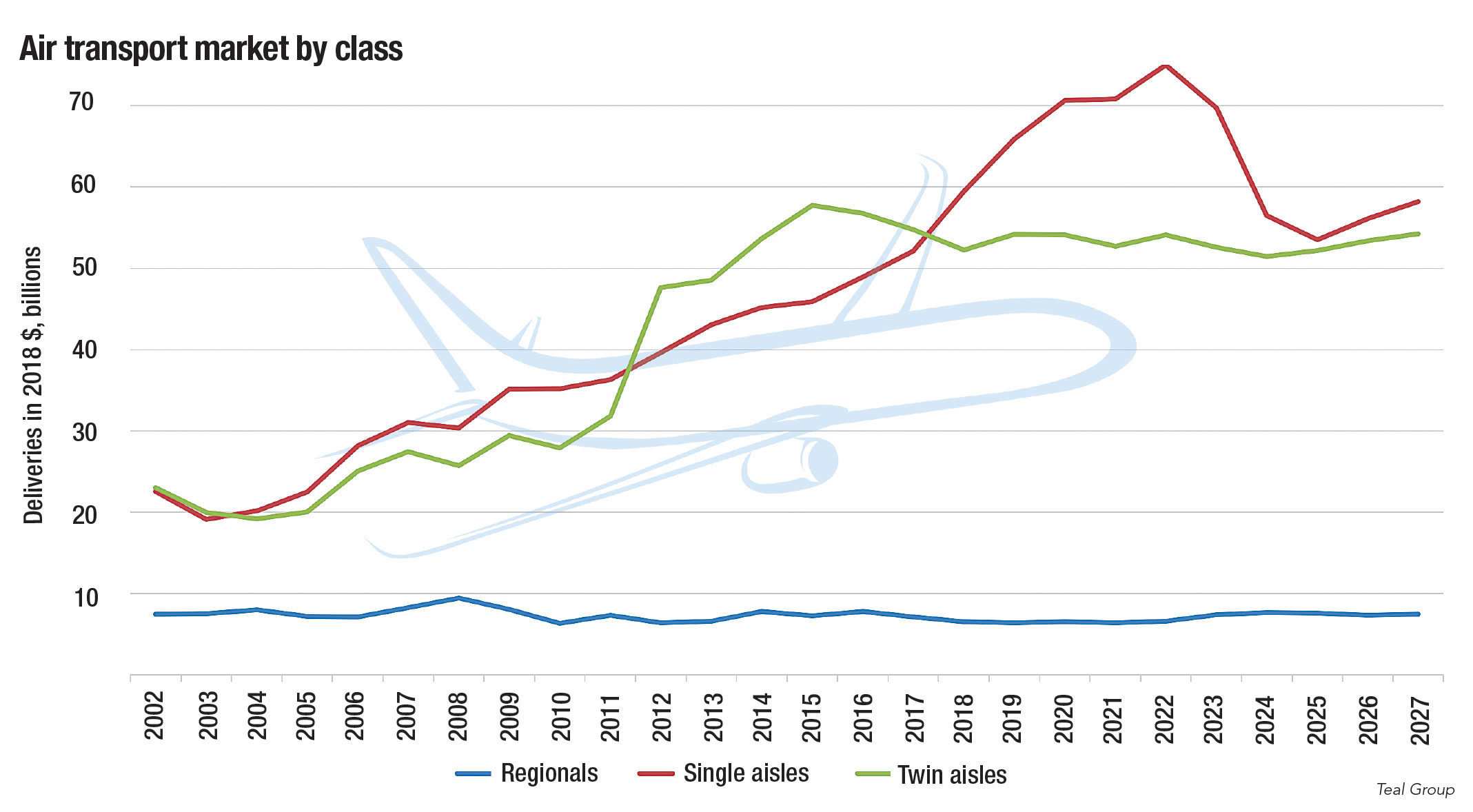

On the other hand, the aerospace industry is gaining steam. The overall outlook is the best in 10 years for the global aircraft market, according to Richard Aboulafia, vice president of analysis for Teal Group Corp., Fairfax, Virginia. For 2018, he expects fighter jets to register the biggest gain at 16.3 percent, all military aircraft to rise 8.9 percent and the total industry to increase 1.9 percent.

He said demand is holding up nicely for large single-aisle jets. However, technical snafus—primarily with producing new engines and machining new castings and forgings made of exotic alloys—have hobbled production for the new generation of those jets. Those engines include CFM International's LEAP-1A, -1B and -1C models and the Pratt & Whitney PurePower PW1524G.

"If it was just up to market demand, you would see more growth this year," Aboulafia said. "But because of those problems with bringing new models online, particularly with building the engines, you're going to see a flat year for them."

One segment of the market that remains underwhelming is business aircraft. This market flatness is in spite of numerous "green shoots" sprouting, including strong corporate profits, strong stock market prices, favorable tax policies and low levels of used business jets on the market, Aboulafia said. "You couldn't ask for a better macroeconomic market. Nothing is happening. It's as flat as it's been for the last decade."

On the global front, China received about 23 percent of all jetliners last year. However, the country's capability to produce a large quantity of high-quality aircraft isn't so extraordinary. "China appears to be moving backward in time," Aboulafia said, while noting that the nation has ample resources and a talented workforce. "The only thing they could be doing wrong is what they're doing."

That assessment is based on two fundamental problems with China's strategy, he added. The first is that the strategy is run by the government rather than the private sector. The second is demanding the transfer of technology without any intellectual property protection. "That is a recipe for people showing up with inferior stuff."

Because of its size, one space to watch carefully is the Chinese market, according to Daco. "We've seen evidence of a slowdown in China. Authorities are trying to fight against a fairly damaging effect from the trade tensions, along with internal slowing of domestic demand."

That scenario is occurring at the same time that emerging markets are experiencing less favorable economic conditions. Daco explained that healthy U.S. economic growth creates a strong U.S. dollar and high interest rates, plus rising oil prices in an environment of tight liquidity. This combination restrains growth momentum for the rest of the world, particularly emerging markets.

Along with rising interest rates, Aboulafia said a key area to watch is whether aerospace manufacturers and suppliers can overcome technical challenges and ramp up production effectively. The complications that trade wars and barriers create are another key area. He added that, to varying degrees, aerospace manufacturers are protected from the U.S.-imposed tariffs on imported steel (25 percent) and aluminum (10 percent) because many subcontractors are based outside the U.S. and have long-term pricing agreements.

"In other words, there are layers of insulation all around, but it is an area of concern and worth watching," Aboulafia said, adding that the industry primarily consumes aluminum, with steel required mainly for landing gear parts.

A Grounded Market

For the automotive industry, it's a different story. Ford Motor Co. has already warned that tariffs have hurt the company's profits to the tune of $1 billion, and U.S. trade policies threaten to play havoc with the automaker's ongoing $22.5 billion reorganization, NBC News reported. Layoffs will center on Ford's 70,000-strong white-collar workforce.

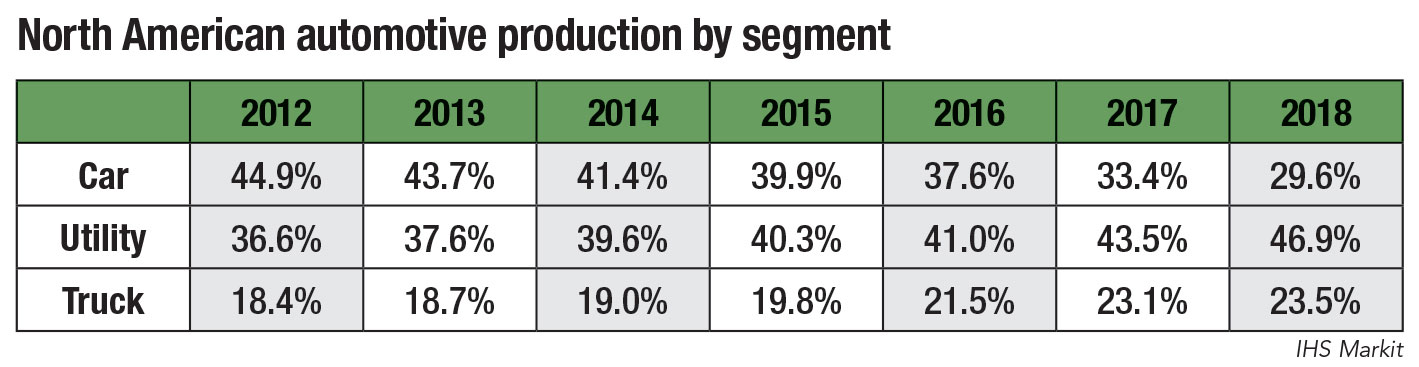

Even with the turmoil and tensions, Eric Anderson, senior analyst of North American production forecasting for IHS Markit Ltd., said the Southfield, Michigan-based business information provider still projects a fairly stable North American production market in the near term. He expects total vehicle sales for the year to be around the 17 million mark. "As a whole, a pretty healthy market."

Anderson added that consumers are expected to continually favor utility vehicles in the midst of relatively low fuel prices and additional utility vehicle offerings throughout 2019.

With the expected implementation of the United States-Mexico-Canada Agreement on trade, duty-free, cross-border commerce will continue among the three countries.

"We're happy to see some resolution," Anderson said about the modified NAFTA pact. "That is something that automakers and suppliers have been watching closely and had a great deal of uncertainty over for the past two years. Certainly, there's a sigh of relief now that there are more or less definitive terms."

New rules contained in USMCA require more of a vehicle's components to be sourced in North America and assembled by high-wage workers to qualify for duty-free treatment, according to The Kiplinger Letter.

"The next big-ticket item, so to speak, would be what's settled with China," Anderson said.

One area that auto part suppliers continue to examine is how they can best structure their operations to service OEMs appropriately and cost-effectively. "Whether it's a transplant opening a plant or even if it's a manufacturing plant that has been open for 30 years, big data will be the overall trend in the industry," he said, with the expectation of a timely return on investment for companies that embrace the trend. (Big data is data that is too large and complex for processing by traditional database management tools.)

Power Planet

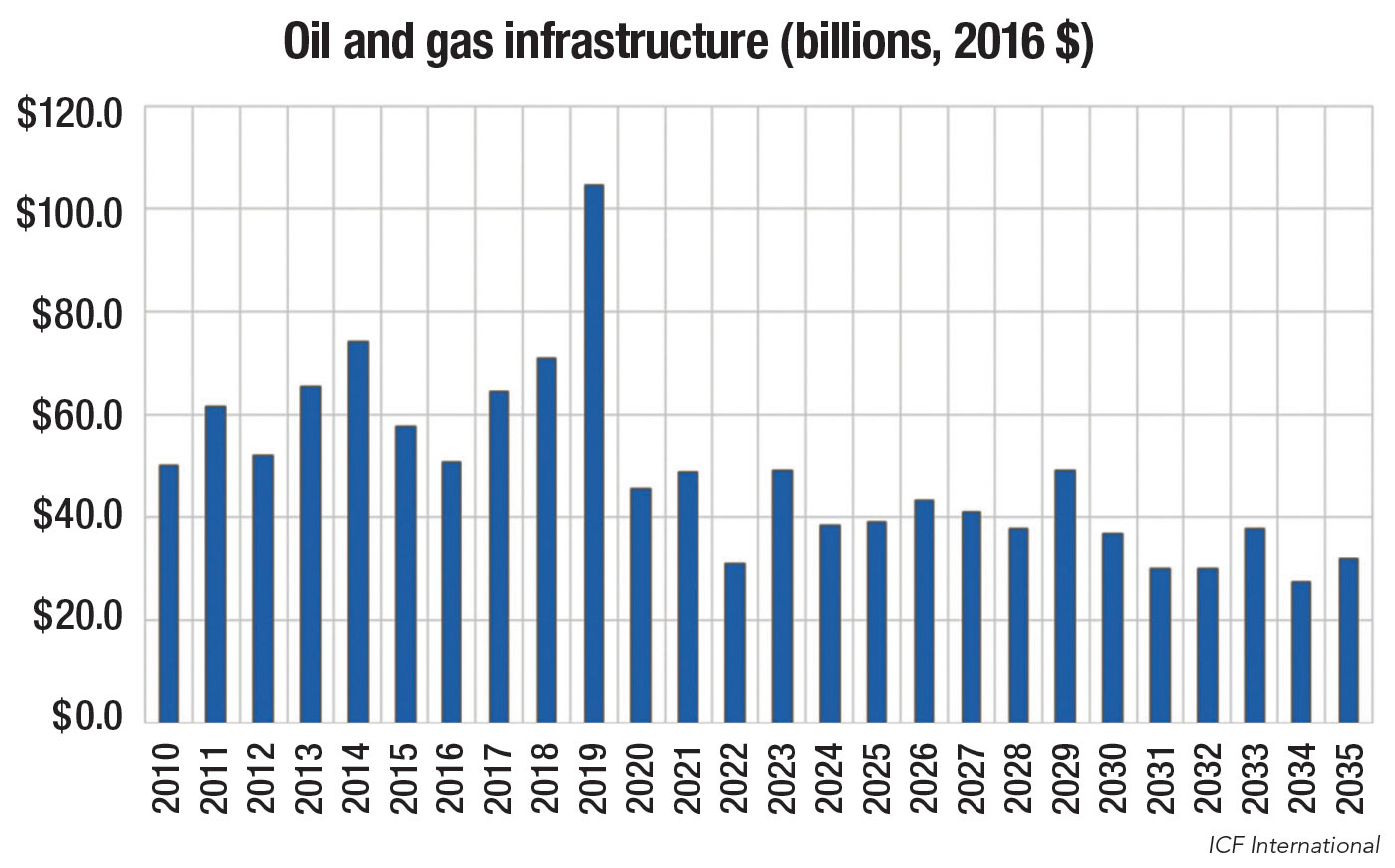

Providing the juice to keep the transportation and manufacturing machinery in motion is the energy industry. As a whole, the industry is on solid footing with energy prices "on the bullish side," said Craig Pirrong, professor of finance and director of the Gutierrez Energy Management Institute at C.T. Bauer College of Business for the University of Houston. "Prices have firmed up, and that's beneficial overall for the energy industry, particularly the upstream industry in the United States. We've seen that reflected in an uptick in drilling activity and rig counts."

Annual average U.S. and Canada capital expenditures, year of commissioning.

In terms of manufacturing activity, the oil boom—especially for the Permian Basin in West Texas and New Mexico and the Bakken Formation in Montana, North Dakota and Saskatchewan—is constraining pipeline capacity, Pirrong noted. As a result, investment in pipeline production is likely to increase.

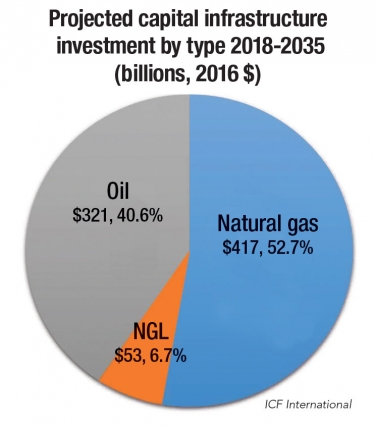

According to the study "North America Midstream Infrastructure Through 2035," which was prepared by Fairfax, Virginia-based ICF International Inc. for the Interstate Natural Gas Association of America Foundation, about 41,000 miles of pipeline will be added from 2018 through 2035 to transport oil, gas and natural gas liquids. An additional 139,000 miles of gathering lines will be added to support gathering, processing and storage of oil, gas and natural gas liquids during that forecast period.

Similar to the auto industry, the energy industry views tariffs on materials, notably steel, in a negative light as they raise the cost of pipeline and liquefied natural gas projects. "As a result," Pirrong said, "some of them will not go forward. It's very bullish on the demand side, but the metal tariffs put a crimp on the supply side."

Globally, however, demand may be weakening in China, creating a mixed picture, he added. "The ongoing situation in China is the biggest wild card."

On the other side of the world, the advantages of the relatively low cost of energy in the States compared with other markets remain a big benefit. "For U.S. manufacturers," Pirrong said, "particularly in the downstream sector, whether it be refining or petrochemicals, the continued availability of relatively cheap feedstock, whether it be natural gas or oil, is a positive."