Sector report: medical parts

Sector report: medical parts

Despite setbacks and challenges, the orthopedic implant market is set to grow.

After years of strong growth, the orthopedic implant market has hit a few bumps in the road.

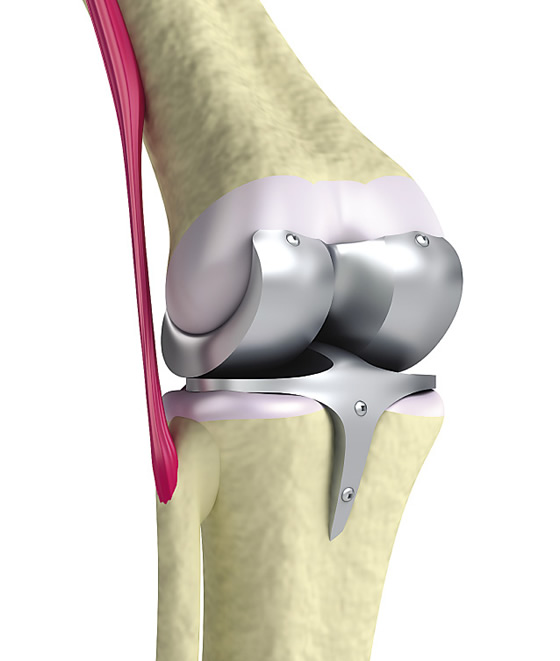

In 2012, knee orthopedic devices, which account for the largest share by revenue of the total orthopedic devices market, were subject to product recalls due to implant loosening, corrosion, wear and manufacturing errors, factors that were expected to have a major impact on total market revenue and reduce the growth rate for knee implants, according to a market report published by Transparency Market Research earlier this year.

Still, the $30 billion worldwide orthopedic implant device market is forecast to grow 5 percent annually during the next 4 to 5 years, according to the report, which noted the hip implant sector remains healthy.

However, the industry's growth model appears to be changing. In a post on the Medical Device and Diagnostic Industry Web site, Senior Editor Arundhati Parmar noted growing pressure to reduce implant prices from private and governmental health care insurance providers is eliminating the incentive for implant makers to introduce "knockoff" products that do not offer any major technical advances, and future sales growth will need to be driven by "truly differentiated" products and services. In the meantime, implant manufacturers have reacted to price pressure by trying to increase their economies of scale through mergers and acquisitions, the MDDI post noted.

Total hip and knee joint replacements, the traditional powerhouses of orthopedic growth, have matured. Room still exists for advancements in such products, but for the most part their foundational breakthroughs have already occurred. On the other hand, the tightly interrelated sectors of spinal implants and biologics (treatments of implants to promote bone growth) have yet to achieve high levels of patient satisfaction or physician interest. One or two big innovations in these areas could send these markets soaring the way knee and hip implants did 15 years ago.

Unwanted Attention

In a way, hip and knee implants fell victim to their own success. They became so popular so fast that the consequent skyrocketing costs to private health insurers and government programs like Medicare and Medicaid drew criticism from policy makers, budget cutters, insurers and government officials. As a result, from 2007 to 2011, inflation-adjusted prices fell 23 percent for hip implants and 17 percent for knee implants, according to a study by the Advanced Medical Technology Association. Over the past several years, hospitals, the main drivers of cost containment, have made a point of buying orthopedic practices, meaning the decision on which implant to use no longer resides primarily with surgeons. Because the hospital now employs the physician, the hospital has far more say in what implant is used, whereas it previously was entirely up to the surgeon.

Implant manufacturers, mostly in the U.S., have responded by consolidating. Zimmer Inc. announced plans to buy Biomet Inc. Last year, Johnson & Johnson bought Synthes Inc., and Stryker Corp. bought Mako Surgical Corp. Rumors continue to swirl around Smith & Nephew and Wright Medical Technology Inc. being gobbled up. While consolidation will help industry giants weather tough times, it may spell bad news for their machine shop and other part manufacturing contractors who will face contracting markets because of fewer implants being produced and price pressure on smaller suppliers.

Additionally, numerous high-profile product recalls and liability class-action lawsuits have taken a bite out of total joint replacement profits. Many of these cases involve metal-on-metal (MoM) moving parts. In June 2012, the U.S. Food and Drug Administration saw fit to launch a safety inquiry into the use of MoM parts in the medical device industry—more bad news for machine shops.

Orthopedic implant screws.

Yet cause for optimism still exists. The bottom line is most hip and knee replacements work very well for people who would otherwise be confined to beds and wheelchairs. Add to that an aging population, an ongoing obesity epidemic, the need for revision surgeries and rapidly emerging global markets—such as Japan, with its large elderly population, and China, with hundreds of millions poised to join the middle class—and industry watchers anticipate continued strong demand, according to the Transparency Market Research report.

The same cannot be said of the $6 billion a year spinal implant market. While this segment is expected to grow roughly at the same pace as knees and hips, patient satisfaction remains much lower; the newer, minimally invasive surgeries—which are difficult to learn—have yet to prove themselves superior in well-controlled clinical trials, according to Tara Shelton, an advanced medical technologies research analyst with Frost & Sullivan, a market research and analysis firm based in San Antonio. Some surgeons simply avoid performing spinal implants because the operations can be problematic.

But these roadblocks could prove to be a blessing in disguise, Shelton said. "The area where there is the most room for innovation is in spine and biologics."

Back pain has plagued humanity since our ancestors began walking upright, and some of the sharpest minds in medicine and engineering are said to be busy devising surgical solutions for this vast market.

Creative Machining

The spinal market's substantial room to mature translates into a wider variety of machined parts. Though spinal fusion remains the gold standard for treating degenerative disorders, the trailblazing edge of this field is predicted to be nonfusion, motion-preservation techniques that allow patients greater mobility. Such surgeries call for not only machined metal, ceramic and polymer interbody parts, but also ones that can expand, contract, rotate and articulate.

Titanium knee-hinge joint.

Another rapidly growing area for both fusion and nonfusion procedures is minimally invasive surgeries. These techniques require the usual machined plates, rods and screws, but also metal proprietary surgical instruments, such as serial dilators, expandable tubular retractors and an array of decorticating tools, such as rongeurs, rasps, awls and curettes—many of which are custom manufactured to fit the needs of individual surgeons.

The most recent trend, lateral spine surgery, continues to show promise, according to a report by www.TheSPINEMarketGroup.com. About a half dozen companies are marketing lateral spinal surgery systems. By entering through the patient's side, rather than the front or back, these surgeries offer advantages. There is less chance of vascular injury than in the anterior approach and less deep back muscle dissection than in the posterior approach, according to the report. The result is a shorter period of postoperative patient healing.

With so many experimental procedures and devices in the works, potential for product turnover will be high. For instance, NuVasive Inc., a San Diego-based, mid-sized OEM that specializes in spinal surgery products, wrote in its 2013 annual report that "A stated goal of our business is to focus on continual product innovation and to obsolete our own products." The company, which relies on third-party manufacturers for most of its products, has grown from annual revenues of $40 million in 2004 to nearly $700 million last year.

Jeff Castleberry, senior manager of NuVasive's in-house prototype manufacturing facility, said his team can barely keep up with demand for new product iterations. "We are marketing the more minimally invasive surgeries," he said, "and more and more of the new products are headed in that direction."

OEMs like NuVasive need machining partners that can examine and interact on a conceptual level with new parts and implants and provide manufacturing advice while simultaneously focusing on the needs of surgeons and patients.

To accomplish this, top-quality shop employees are even more important than access to top-quality equipment, said Steve Storlie, vice president of business development at Mendell Inc., Lakeville, Minn., which specializes in manufacturing spinal implants.

Mendell manufactures spinal implants, including polyetheretherketone (PEEK) interbody spacers, titanium interbody spacers, cervical plates, facet screws and pedicle screw systems.

To manufacture these products, the company utilizes CNC Swiss-machining centers with up to 12 axes, high-speed, multiaxis milling centers with up to five axes and 4-axis wire EDMs. In addition to its precision machining operations, Mendell performs secondary finishing operations to meet the demanding aesthetic requirements of medical industry customers. These operations include laser marking, bead blasting, microblasting, powder blasting, pin tumbling and various chemical finishing processes.

Orthopedic medical plates.

Demand for spinal spacers, often made from PEEK, has been high, according to Storlie. "There has been a big push toward PEEK in the last 6 years or so," he said.

Spacers are important components of spinal fusion surgery. The goal of fusion surgery is to separate one or more vertebrae to alleviate patient pain and then induce vertebrae to fuse together via new bone growth. Paradoxically, although the industry as a whole is moving away from metal and towards polymers like PEEK, titanium is better at promoting bone growth, so it is still popular in fusion surgery, where there are no MoM parts.

"There are new methods of bonding various coatings to PEEK spacers, one of which is titanium, in an attempt to further bond the spacer with the bone," Storlie said.

Polymer's Ascent

With MoM parts in disfavor, anyone who works in the orthopedic implant field needs to become familiar with the rapidly evolving field of engineered polymers. Once thought to be too weak for load-bearing implants, polymers came into their own with the rise of PEEK and materials like it. Much less expensive than titanium, PEEK is strong, flexible and light, with a strength-to-weight ratio similar to cortical bone. The material also has a long fatigue life, lasting a long time in the body without wearing. Its high elasticity/" data-glossary-id="141729" data-glossary-teaser="Measure of rigidity or stiffness of a metal, defined as a ratio of stress, below the proportional limit, to the corresponding strain. Also known as Young’s modulus." title="Measure of rigidity or stiffness of a metal, defined as a ratio of stress, below the proportional limit, to the corresponding strain. Also known as Young’s modulus." aria-label="Glossary: modulus of elasticity">modulus of elasticity makes it popular for spinal devices, whose goal is to create compliant structures that minimize loss of patient movement.

Unfortunately, unlike other materials used in implants, PEEK is biologically inert and doesn't promote bone growth. Here is where biologics comes in. A whole cottage industry has sprung up around making PEEK more "osteoblast friendly," the two main strategies being surface modification and composite preparation. Surface modification includes everything from plasma sprays to chemical treatments to coatings. Hydroxyapatite and titanium are the most popular coatings. Composite preparation entails mixing PEEK with bioactive materials, like donor bone chips, before implantation, according to a paper, "Current strategies to improve the bioactivity of PEEK," published in the International Journal of Molecular Science.

As new product development continues, some shops are turning to in-house 3D prototyping during the design process. New-generation 3D printers are more precise and much less expensive than their predecessors. In some cases, prices have dropped by two-thirds in the last 5 years.

"Companies like ours took a leap of faith 12 or 14 years ago," said Jon Cobb, executive vice president of government affairs for printer manufacturer Stratasys Ltd., Edina, Minn. "We said, more or less, 'If we build them, they will come.' And that has paid off."

In a case study featured on its Web site, Stratasys describes how one of its orthopedic customers moved all its 3D printing jobs in-house. "Most design shops outsource rapid prototyping because the high-end equipment required has traditionally been very expensive," stated Brian McLaughlin, a manager at Orchid Design, which has locations in Shelton, Conn., and Memphis, Tenn., in the case study. When his shop bought its own printer, rapid prototyping jobs sped up by a factor of 10 to 20, "from weeks to hours," he said. "We now produce rapid prototypes for virtually every project. And that has helped us reduce the average overall product development cycle by about 20 percent."

Brave New World

Although in the short term the manufacturing sectors that support orthopedic OEMs should remain healthy, it is unclear how long this will last. For one thing, the rise of robotics could all but obviate the need for the lucrative field of new instrumentation manufacture, according to forward-thinking orthopedic surgeon Dr. Kevin R. Stone, chairman of the Stone Research Foundation, San Francisco.

"What robots are going to do—and this is why Stryker bought Mako, by the way—is that every time an implant company wants to come out with a new version of their hip or knee implant, instead of creating all new sets of cutting guides and instrumentation and everything else they had to do in the past, now they just have to change the computer software.

"In my practice, we use a robot every time we do a partial knee replacement," Stone continued, adding that robotic full knee and spinal surgeries are imminent. "It's now an outpatient procedure." CTE

Contributors

Frost & Sullivan

(877) 463-7678

www.frost.com

Mendell Inc.

(952) 469-5500

www.mendell.com

NuVasive Inc.

(800) 475-9131

www.nuvasive.com

Stone Research Foundation

(415) 921-1220

www.stoneresearch.org

Stratasys Ltd.

(800) 801-6491

www.stratasys.com