A Weighty Matter

A Weighty Matter

The global heavy equipment market is projected to grow at a 4.4% CAGR, driven by advancements in automation, telematics, and infrastructure investments.

It's obvious that excavators, bulldozers, cranes, backhoes, dump trucks, forklifts, graders and trenchers are all heavy equipment, as are other machines and vehicles for industries that include construction, mining, agriculture, material handling, forestry and shipping. What is not as obvious, however, is the outlook for the heavy equipment market.

Metrics to help understand the market are its value and compound annual growth rate (CAGR). The value of the global heavy equipment market last year was $202.95 billion and that is expected to grow at a CAGR of 4.4%, said Himanshu Gope, research analyst at New York-based Polaris Market Research, which has an Asia-Pacific Intelligence Center in Pune, India. "To name a few segments, material handling equipment is projected to grow at a high CAGR and is mainly driven by the rise and focus on workplace safety and recovery, and the construction industry and increasing mining activities."

The market intelligence and consulting firm reports that its economic insight and analysis of the heavy equipment market encompasses a thorough examination of market dynamics, including supply and demand factors, technological advancements, regulatory impacts and economic indicators that influence market growth.

The outlook for the heavy equipment and industrial machinery market remains positive, driven by ongoing urbanization, infrastructure development and industrialization across both emerging and developed economies, noted Likhil Ga-jbhiye, research manager for Polaris. Technological advancements, such as automation and telematics, or fleet tracking software and devices, are also enhancing the capabilities and efficiency of heavy machinery.

"Recent events, such as the global supply chain disruptions and economic uncertainties due to geopolitical tensions, have impacted the market," he said. "However, recovery is expected as economies stabilize and investment in infrastructure projects resumes."

When comparing global regions, the North American market is driven by significant investments in infrastructure and construction projects, Polaris reports. The adoption of advanced technologies and strong emphasis on sustainability are notable trends. The European market is also supported by initiatives to modernize infrastructure, as well as to promote "green" construction practices. Rapid urbanization, industrialization and government-led infrastructure initiatives are key growth drivers in the Asia-Pacific region, with China and India being the major contributors to market expansion. In Latin America, economic recovery and investments in mining and construction projects are boosting market growth, while infrastructure development and oil and gas projects are driving heavy equipment demand in the Middle East and Africa.

Nonetheless, the consultancy added that manufacturers of heavy equipment face an array of challenges. They must ensure a resilient supply chain through diversification and enhanced logistic capabilities, keep pace with rapid technological changes through continuous investment in R&D, adhere to stringent environmental and safety regulations through compliance management and sustainable practices, and address workforce challenges by investing in training and development programs to build a skilled labor pool.

Machining Might

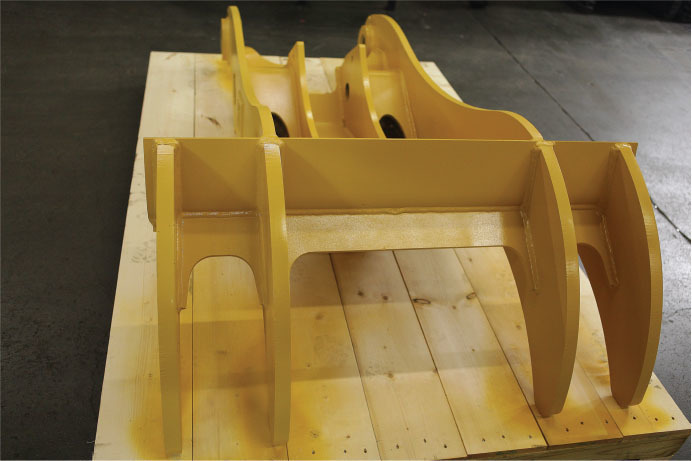

Baker Industries, a Lincoln Electric company, is one manufacturer that serves OEMs and Tier 1 suppliers in some of the world's most demanding industries and is seeing a strong market for large, heavy components, according to General Manager Brian Baker. Among other capabilities, the Macomb, Michigan-based company designs tooling, does heavy fabrication work such as weldments, tube forms and I-beams, and offers machining services. "We handle projects of all sizes, including components and assemblies up to the size of a semi-truck."

He added that the contract manufacturer also 3D-prints parts such as large boom arms for agricultural applications. "We're starting to see momentum in that space."

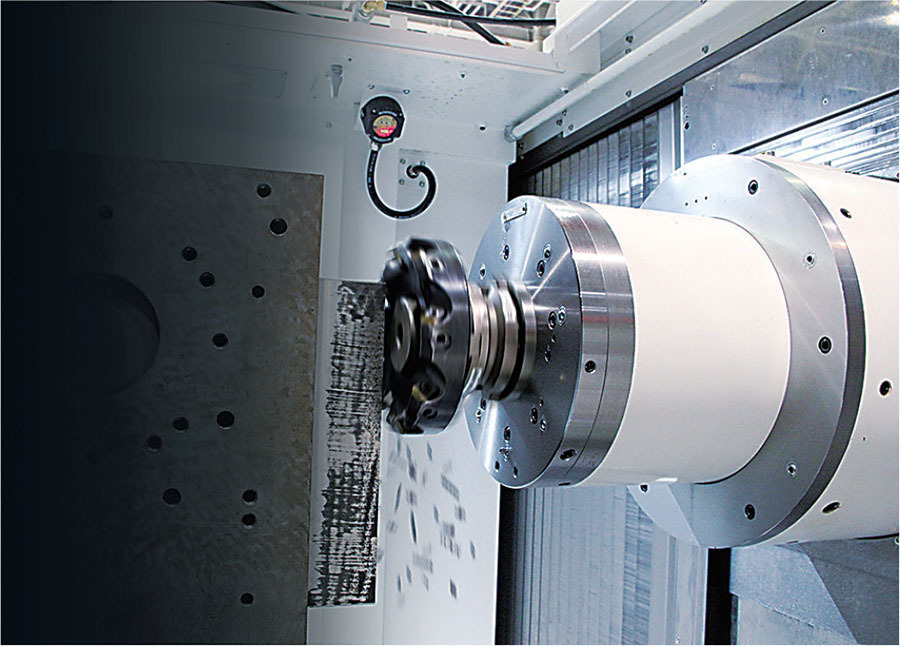

With many of its large machining centers booked for a year, Baker Industries purchased two 5-axis machining behemoths. The Emco Mecof Powermill HP5 gantry machining centers will further advance the manufacturer's large machining capabilities for the aerospace, automotive, defense, energy and shipbuilding industries. Both should be producing chips by the end of the year, or early next year.

Baker emphasized that the company's philosophy is to not have a single point of failure, such as preventable bottlenecks, but realized that there are times it could not fulfill that requirement because of a backlog. "If we're looking to add one machine to our equipment list, when it's possible, we strategically try to add two machines, ensuring that we can meet customer demands without bottlenecks. We try to build in redundancy, providing customers with a lot of peace of mind."

Machining the big stuff is not for the faint of heart — nor the impatient. With some of the larger parts on a machine for weeks or even months, which helps to keep machines nearly fully booked to justify the capital investment, Baker said customers must understand that going too fast is not in their best interest. "We meticulously plan our machining programs and establish fixed processes, with our quality team involved at every stage, to ensure precision and excellence from start to finish."

Adding to the challenge, he noted, is a customer's engineering change that causes cascading effects and can push back the due date, which typically is not acceptable to the customer. "With additional machines, we can mitigate schedule delays and provide critical support to our customers' timelines, ensuring that any program setbacks are swiftly addressed."

Having the appropriate machine tools is not the only equipment requirement. Handling large parts can be difficult, Baker said, so the manufacturer needs cranes and with suitable capacity to move the parts, as well as the proper riggers and knowledge to move them safely.

Even the facilities are a big deal, he added. One project required installing new overhead doors because the existing ones were not large enough. In addition, having adequate space in a production plant is critical. "Space requirements can change quickly, and what appears to be empty one day can become a critical area for storing and maneuvering large components the next. Effective logistical planning is essential."

A project might require a massive frame to serve as the backbone, for example, but not all elements are enormous, Baker noted. "Many jobs involve dozens or even hundreds of smaller details, sometimes only a few inches or feet in size, that are fabricated, machined and assembled concurrently with larger details. This parallel processing is crucial to our workflow."

Equipment for Heavy Equipment

Another machine tool builder that offers equipment for producing large parts, as well as smaller ones, is Mazak Corp. in Florence, Kentucky. For machining large shafts, for example, Mazak offers 2-axis lathes from its parent company in Japan and the Kentucky-built Quick Turn 450 CNC turning center and Quick Turn 450M with multitasking capability for milling features, said Jason Taylor, Advantec product manager, who serves the job shop market.

Another offering is the VC-Ez 32 vertical machining center, which is the largest version of Mazak's Ez series and introduced at IMTS, Taylor noted. "It's more of an entry-level machine, but it has a very large table and with the 50-taper spindle gives us the opportunity to have more heavy cutting."

Jared Leick, machining center product group manager, who handles the other end of the builder's equipment spectrum, said the HCN-6800 NEO horizontal machining center is available with a hightorque, high-horsepower spindle for aggressively cutting steel, with 8620 steel being common for heavy equipment components.

In addition, Leick noted that he handles larger VMCs for machining parts such as differential cases, cylinder heads, connecting rods and large weldments.

Like other sectors, the heavy equipment market is increasing adoption of autonomous machinery and robotics to boost productivity and safety. Taylor said Mazak's larger corporate accounts are using large 3-axis robots on rails to load and unload parts and gantry robots positioned in front of machines.

"They are definitely going towards automation equipment even for extremely large components to the point where it's very hard to believe because of the size. It's pretty incredible, but that's almost a mandate now from a lot of our customers."

Having a robot lift and maneuver massive parts also enhances worker safety compared to an operator lifting them with cranes and other devices, Leick added, as well as helping to overcome skilled labor shortages through automation.

The heavy equipment market is fairly steady, according to Leick, with engine production slightly up and the construction sector being a bit busier than agriculture. "It's not setting records, but not extremely dead."

Considering Corporate Culture

Heavy equipment parts and products are different from other markets, but the approach to fostering a positive work environment and serving customers is universal.

To achieve success in the heavy equipment market, a corporate culture that fosters innovation, agility and customer-centricity is critical, according to Gajbhiye at Polaris Market Research. "Emphasizing continuous improvement, collaboration and sustainability can drive growth and competitive advantage. Companies should also prioritize safety and quality to meet regulatory standards and customer expectations."

Quality is a major requirement for success, as well as being transparent with customers, Baker emphasized. "Never hide anything from a customer. Never ship something with imperfections. That's a culture you must have; you have to be the most transparent and have the highest integrity of all of your competitors in the space. That's how you set yourself apart and bring in work."

Messaging is also critical. "It's all about communication — making sure everybody's on the same page," Baker said. "By maintaining open lines of communication with our customers, we minimize avoidable errors and proactively manage potential issues, reducing waste and ensuring quality."

He noted that Baker Industries started in the automotive and injection molding business before moving into heavy equipment, large fabrications and massive machine work. When targeting the heavy equipment market, Baker recommends beginning with easy, small projects and working your way up. In addition to ISO 9001, a number of certifications are required for this type of work. "Building mutual trust with customers is fundamental, although it can be challenging. Establishing strong, mutually beneficial relationships is essential for success in this industry."

Mazak's Leick cautions that the heavy equipment market is difficult and highly competitive to penetrate when new to it. "There's not a lot of people [who] are going out buying new machines, trying to break into that market. Seems like it's just people replacing older equipment to stay in the market."

Nonetheless, the heavy equipment market is poised for growth, driven by technological advancements and increasing infrastructure investments, Gajbhiye said. "Manufacturers must stay agile and innovative to navigate market challenges and leverage opportunities, embracing digital transformation and sustainable practices will be key to long-term success in this evolving market."

Fluid Management in Heavy Equipment Manufacturing

In the production of heavy equipment for construction, forestry, mining and other industries, a variety of metals are used based on the performance requirements of the end-use application. These metals can range from carbon alloys used for strength and structural integrity to lightweight metals like aluminum and stainless steel, which provide corrosion resistance. Managing these materials in different metalworking applications, such as rolling, bending, forging, milling, grinding and drilling, is key to the manufacturer's overall efficiency and profitability.

The industrial process fluid that enables operation is critical to these metalworking applications. A particular metalworking operation is only as good as how well its process fluid, also known as "metalworking fluid," is managed.

Metalworking fluids typically provide three main functions: lubrication to remove friction between a tool and the workpiece, cooling to remove generated heat, and/or flushing to remove metal chips and fines.

In the case of coolants, many are water-soluble and applied as emulsions with a particular ideal concentration. Because concentration can vary due to natural evaporation or discharge, careful monitoring is recommended. Not maintaining optimal fluid concentration can lead to various problems, such as overconsumption of coolant, tool breakages, part defects, corrosion and even health and safety issues.

Though heavy equipment manufacturers have automated many parts of their manufacturing process, often the monitoring of metalworking fluid is done manually via regular collection of samples that are either sent to a laboratory for further analysis or are tested at the point of use with simple instruments like a refractometer. The labor effort for sampling alone can be significant. By the time laboratory analysis is completed, system conditions have changed. Alternatively, if an analog refractometer is used, human error can be introduced. Even when readings are accurate, replenishing fluid is still necessary to correct the concentration, a process which is often done manually.

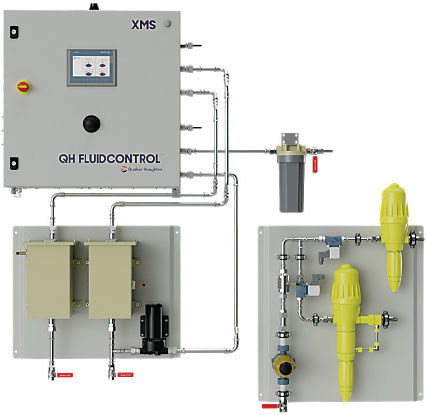

While some companies and suppliers have offered hardware to perform some fluid measurement or control, most have varying degrees of practicability and reliability, or have not been built to deliver significant and useful insights. Some industrial process fluid leaders have made significant progress in introducing complete automation and control technologies for digitally optimizing fluids and processes. For example, Conshohocken, Pennsylvania-headquartered Quaker Houghton has partnered with end users to understand customer needs in fluid management, like a fully automated hardware solution that is customizable, scalable and easily integrated into the manufacturing system, paired with user-friendly software giving real-time, accurate and actionable insights.

A significant Quaker Houghton investment has enabled trialing various sensors and control technologies in numerous fluid applications. The experience and knowledge gained has evolved into the QH Fluid Intelligence platform. This digital platform, which includes hardware customized to the company's fluids and proprietary software for real-time continuous monitoring, control and data analytics, combines all the elements necessary to allow manufacturers to optimize fluid management. By digitally optimizing processes, manufacturers can refocus resources on their core business of efficiently producing high-quality, competitive products.

Like many manufacturing sectors, the heavy equipment manufacturing sector is challenged with improving quality, increasing efficiency and lowering costs to stay competitive. A top OEM of heavy equipment for the agricultural industry was facing challenges with coolant stability in its grinding operations. Poor fluid management practices led to bacteria and fungi, making coolant used in a critical gear tooth face grinding operation unstable. Poor coolant performance led to increased scrap, maintenance and production costs. The coolant delivery system piping had to be manually cleaned out, which consumed five days of production time every quarter. The OEM contacted Quaker Houghton for a solution. Quaker Houghton recharged the OEM's grinding system with a fully synthetic coolant and deployed its digital platform, including hardware to automatically control the coolant system and software to provide real-time data logging and analysis. Using this platform, the OEM reduced operational costs by about $300,000 annually and decreased machine downtime by 75%, equivalent to over 1,000 hours of additional productive time per year. The now stable and controlled coolant environment enhanced production efficiency, increased output and reduced costs.

For more information about Quaker Houghton, call 610-832-4000 or visit www.quakerhoughton.com. —Quaker Houghton