Haphazard tariffs are a bellwether for a manufacturing sector slowdown

Haphazard tariffs are a bellwether for a manufacturing sector slowdown

When geopolitical decisions, whether regulatory, tax or immigration, appear to be made arbitrarily, it's going to cause pullback by business leaders. The current climate of tariffs, uncertainty and risk is a wake-up call for a slowdown.

When geopolitical decisions, whether regulatory, tax, or immigration, appear to be made arbitrarily, it's going to cause pullback by business leaders. The current climate of tariffs, uncertainty and risk is a wake-up call for a slowdown.

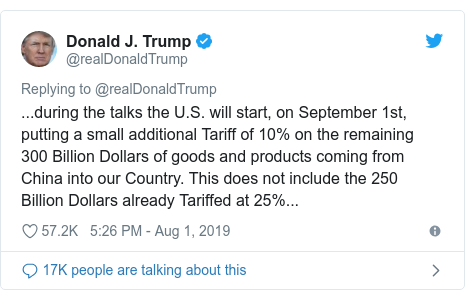

Tariffs are a complex, multi-variant equation, and how it all settles out is anybody's guess. Without a description of the overarching goals, and a clearly articulated pathway to achieving those goals, the tariffs become reactionary. This random approach causes uncertainty, and uncertainty equals risk, and risk makes business leaders pause and delay or cancel capital investments.

We can all agree that free trade amongst partners means all should operate under the same rules, and with rule of law comes wealth creation. Free trade also creates the opportunity for free-flowing capital and is a catalyst for reducing poverty, which we've witnessed happen over the past 30 years. When all don't play by the same rules, unbalance results.

Protecting ownership rights is important. Saying you want to create manufacturing jobs domestically in the short-term is another noble thought. That cannot come at the price of damaging relationships with countries with whom we are historically good trading partners.

Tariffs ultimately may be a good tool to get our partners to set a new level playing field and create a standard set of rules that everybody lives by, including rule of law governing intellectual property and ownership rights.

China has a whole lot more to lose than we do, at some point they will need to give at least the appearance of acquiescing to some of our demands. That too will generate even more animosity, and more unknown risk. Meanwhile, farming, small business (and soon other sectors) domestically here feel the impact.

When this administration came in, risk was lowered in the form of lowered tax burden and less regulation, which increased confidence and willingness to invest, particularly in new technology and processes to increase productivity.

A great deal of capital investment over the past two years has yet to be fully deployed. Rather than making new capital investments, businesses in second half 2019 will instead focus on managing operations more efficiently and optimizing and driving value from prior investments. Concurrently, labor rate hikes will cause manufacturers to put a renewed emphasis on automation and productivity enhancements.

Indeed, for the manufacturing sector there is a continued shortage of both skilled and unskilled labor. An immigration policy that could address labor shortages both near and long-term would be ideal, but unfortunately that legislation is a long way off. Many of my peers are grappling with how to get more output with the people they have today, without frying them. In this climate, businesses need to get better at culture-building, competing, recruiting and retaining talent.

Haphazard tariffs are a bellwether for a manufacturing-sector slowdown. The 2020 election will further underscore the feeling of increased risk and economic uncertainty. Smart companies should start preparing now.