ISM: Economic growth to continue throughout 2017

ISM: Economic growth to continue throughout 2017

Economic growth is expected to continue in the U.S. throughout the remainder of 2017, say the nation's purchasing and supply executives in their Spring 2017 Semiannual Economic Forecast. Expectations for the remainder of 2017 continue to be positive in both the manufacturing and non-manufacturing sectors. Sixty-four percent of respondents from the panel of manufacturing supply management executives predict their revenues will be 8.5 percent greater in 2017 compared to 2016, 12 percent expect a 9.6 percent decline, and 24 percent foresee no change in revenue.

Economic growth is expected to continue in the U.S. throughout the remainder of 2017, say the nation's purchasing and supply executives in their Spring 2017 Semiannual Economic Forecast. Expectations for the remainder of 2017 continue to be positive in both the manufacturing and non-manufacturing sectors.

Sixty-four percent of respondents from the panel of manufacturing supply management executives predict their revenues will be 8.5 percent greater in 2017 compared to 2016, 12 percent expect a 9.6 percent decline, and 24 percent foresee no change in revenue. This yields an overall average forecast of 4.4 percent revenue growth among manufacturers for 2017.

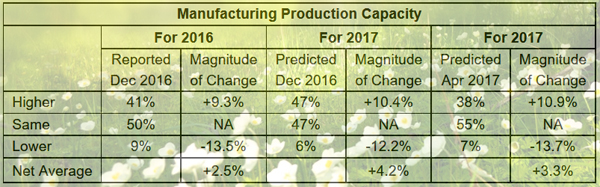

This current prediction is 0.2 percentage point below the December 2016 forecast of 4.6 percent revenue growth for 2017, but is 3.5 percentage points above the actual revenue growth reported for all of 2016. With operating capacity at 82.5 percent, an expected capital expenditure increase of 5.2 percent, an increase of 2.5 percent for prices paid for raw materials, and employment expected to increase by 1.3 percent by the end of 2017 compared to the end of 2016, manufacturing is positioned to grow revenues while managing costs through the remainder of the year. "With 17 of the 18 industries within the manufacturing sector predicting revenue growth in 2017, when compared to 2016, U.S. manufacturing continues to move in a positive direction," said Bradley J. Holcomb, chair of the ISM Manufacturing Business Survey Committee.

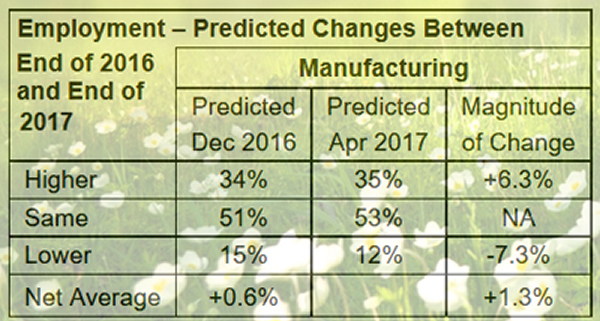

Employment Predictions: ISM's Manufacturing Business Survey respondents forecast that manufacturing employment will increase by 1.3 percent by the end 2017 compared to the end of 2016. Thirty-five percent of respondents expect employment to be 6.3 percent higher, while 12 percent of respondents predict employment to be lower by 7.3 percent. The remaining 53 percent of respondents expect their employment levels to be unchanged for the remainder of 2017.

Offshoring, Post-election Spending Plans and Other Questions: The Manufacturing panel was also asked questions related to the impact thus far in 2017 of the following:

- Is your organization actively off-shoring or re-shoring "significant" volumes of manufacturing? Responses: "We are actively off-shoring." (18.5%); "We are actively re-shoring." (9.9%); "We are actively doing neither." (71.6%). Reasons given by those who are actively off-shoring were "Cost advantage of host country(ies) we will use going forward." (81.4%); "Shortage of usable plant/asset capacity in the U.S." (7.0%); and "Other." (11.6%).

- Since the national election last November, has your firm increased, decreased, or left unchanged its capital spending plans for this year? Responses: Increased (19.7%); decreased (6.0%); and no change (74.2%). Reasons given by those who said they were increasing were: General business outlook (71.7%); prospects for regulatory reform (17.4%); and other (10.9%).

- An increase in pricing power enables a firm to raise prices without losing business to a competitor. Over the past six months, has your firm seen a change in its pricing power? Responses were: Yes, more pricing power (18.3%); yes, less pricing power (21.7%); no change in pricing power (46.5%); and unsure (13.5%).

- Do you believe your supply chain will be able to meet your company's 2017 delivery needs? Responses were: Yes (96.6%) and no (3.4%).

Edited from publicly released information by ISM; the full report is here.