Despite economic turmoil, vertical machine tool builders are keeping their customers and themselves in the game with new technology, services and added value.

“Bad Credit? No Credit? No Problem!” was the motto of the era of reckless lending and spending that has produced chaos for the world economy. Those words now ring hollow for potential buyers of big-ticket items like homes and cars who can’t get loans to make the purchases or are nervous about making such large financial commitments.

Among the sellers of those big-commitment items are machine tool builders. “We are in the same boat as everyone else,” said Greg Hyatt, vice president and chief technical officer for Mori Seiki U.S.A. Inc.’s Machining Technology Laboratory in Rolling Meadows, Ill. However, he noted a range of variation from market to market. “Some markets remain strong, and some are disastrous.”

But even among the disasters are some silver linings; while automotive, for example, is severely depressed, “We are seeing some reinvestments there because the move to more fuel-efficient engines requires some retooling,” Hyatt said.

Jeff Kalyniuk, product technical specialist, machining centers for Haas Automation Inc., Oxnard, Calif., agrees that pockets of positive activity exist. “There’s movement in the tech industries, microwave and power generation, and aerospace is doing well too,” he said. Some parts of global markets are strong; “In January, I attended the IMTEX show in India and visited three customer shops and was surprised to see that all were running three shifts, 24 hours, 7 days a week.” India, he said, “is a different situation. They have a huge internal economy; government officials there were actually forecasting growth in 2009.”

Courtesy of Mori Seiki

Some shops see the economic downturn as an opportunity to adopt new machine technologies they were too busy to consider until recently. An example is Mori Seiki’s NMV line of VMCs, which can be configured to perform turning and 5-axis milling.

In the current economic climate, machine tool buyers are often skittish when commitment time looms, according to Rod Tojdowski, manager of applications engineering at Okuma America, Charlotte, N.C. “Since the first of the year, when we get to the finish line in a lot of cases, they are holding back to make a new purchase until they get some comfortable feeling that the economic times are going to turn around,” he said. “It will come to a point where that will turn the other way; they will realize this is perfect timing to get a new piece of equipment, prove it out and be ready when the real production needs do come down the pike.”

Hyatt said many shops are changing their machining strategies in response to the economy. “We are not seeing people buying machines just for capacity. During the boom we had many customers saying, ‘I need three more machines or 10 more machines, just like the ones I’ve got.’ They were just duplicating what they had done in years past—at a furious pace. Well, that stopped; people don’t need that level of capacity increase any more. Now they have become a little more reflective. They are looking at their machining strategies and are going to start implementing some of the new technologies they’ve been aware of but haven’t had time to pursue.”

Vertical Values

Demand for vertical machining centers, the workhorse machines for many shops, reflects those trends. Hyatt said although interest in simple 3-axis VMCs purchased to add capacity is soft, there is growing interest in 5-axis VMCs.

For example, he cited Mori Seiki’s NMV machines, which can be configured to perform turning and 5-axis milling. “Basically, what we have been calling mill/turn machines (lathes with milling capacity) should have been called turn/mill machines,” he said. The NMV line can properly be called a mill/turn because it is based on a milling platform. “It looks like a VMC, but can be configured to perform turning operations,” Hyatt said. Popularity of the line has prompted Mori Seiki to expand it to handle a broader range of applications. A smaller 300mm-pallet version was introduced in April 2009, and larger versions are under development.

Apart from the traditional markets for 5-axis technology, such as low- to medium-volume medical and aerospace applications, there is growing interest in higher-volume situations such as construction equipment machining, Hyatt said. Instead of buying four mills and four lathes, a higher-volume facility might acquire eight identical mill/turn machines. “The total number of machines is the same, but the material handling process is much simpler, resulting in much lower investment in automation and material transfer,” he said.

Machine utilization can be higher, because the shutdown of one machine doesn’t affect the others, and reducing part movement between machines minimizes fixturing errors and thereby improves part quality. Compared to the multimachine cells of lean manufacturing initiatives, Hyatt said, “There are applications where lean is a legitimate solution, particularly where delivery is not as urgent and where there is excess capital equipment. Then, if the cell goes down it’s not a crisis.” But in short lead-time situations, “that’s a very unattractive business case,” he said. “The bucket brigade fails if there is one missing link. There are those in the lean community who are starting to realize that mill/turns are the new lean.”

Haas’ Kalyniuk said machine tool builders that can afford it are taking advantage of time and resources freed up by production slowdowns to develop “some new products that go into areas we really haven’t explored in the past.” One example is Haas’ new DT-1 drill/tap machine, introduced at WESTEC 2009. It was engineered, Kalyniuk said, for applications involving drilling, tapping and medium-duty milling, such as die castings in the electronic and automotive industries. He pointed out that Haas traditionally met those applications with fast, small-frame VMCs. However, he said, the VMCs “are a little larger than what the production houses like, so we are making a machine that sizewise is a better fit for their use.” Tapping at 5,000 rpm also is faster than a typical VMC. Compared to a small standard VMC, Kalyniuk said, the DT-1 is aimed at “a somewhat new market for us.”

Need for Speed

Scott McIver, chairman and vice president of product development at Methods Machine Tools Inc., Sudbury, Mass., said speed is also a key feature and benefit of the 30-taper Fanuc Robodrill marketed by the company. Demand for the machines is steady, he said, because “they are so universal. They work for job shops, they work well for manufacturers in anything from medical to optics to guns.”

The Robodrill, made by Fanuc in Japan, costs about 20 percent less than a typical Japanese-built 40-taper machine, McIver said, and “what you gain is speed.” Chip-to-chip time (24,000 to 0 to 24,000 rpm) is less than 3 seconds. “That’s valuable if you have a lot of drilling or small endmill work,” he said. “With the Robodrill, it’s all about fast cycle times. A less-expensive solution that is more productive is certainly getting a lot of people’s attention in this economy.”

The machines are offered in three models that are identical except for X-axis travels, which are 12 ", 24 " and 27 ". The latter is the most popular version, McIver said, because it provides the option of putting three or four vises on the table to perform more operations or machine more parts.

In response to customer demands for ways to reduce labor costs, Methods Machine Tools offers a version of the Robodrill teamed with a Fanuc LR Mate robot in what it calls a Jobshop-Cell robotic system. “The machine can load/unload all by itself for 2 or 3 hours while the operator is off doing something else,” McIver said.

Courtesy of Methods Machine Tools

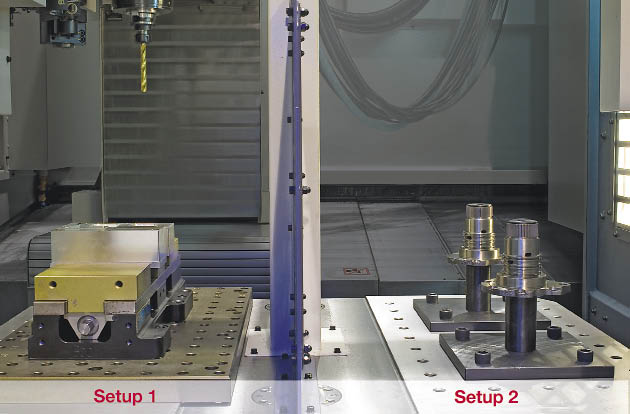

The Kiwa V21i-R VMC from Methods Machine Tools enables a shop to machine two setups in one operation, maximizing run time.

Methods also markets a Kiwa machine that McIver calls “A 40-taper production center.” The rapids and maximum spindle speeds of the Kiwa V21i-R VMC are not as fast as the smaller Robodrill machines, but the larger, more powerful spindle and extra mass is “for those guys who machine aluminum but who also do nickel-base alloys and titanium,” McIver said.

A pallet changer enables a shop to set up one job while another one is being machined, maximizing run time. The Robodrill is offered in fixed-table and side-by-side pallet configurations, while the Kiwa comes only as a lazy-Susan-style rotary pallet changing machine. “The rotary pallet changer provides the ability to run hydraulics and vacuum systems through the center of the pallet and add special fixturing and a 4th axis without the hassles of running umbilicals in and out of the machine, as would be necessary with side-by-side pallets,” McIver said.

According to Okuma’s Tojdowski, new hardware isn’t the only way to upgrade a VMC. Machine controls that expedite handling of machining data can also improve productivity and reduce costs. Okuma’s OSP-P200 THINC control provides various data collection and management capabilities, he said. Without the control technology, he said, “Typically, after machining a part, an operator will then measure it. The operator then writes down the dimension, types the number into a PC or collection unit, then after analyzing it, the operator returns to the machine control to update the tool offsets.” With THINC, the operator can employ gages such as those from Mitutoyo or Brown & Sharpe.

“After you measure the part, you hit the button on the gage and it automatically sends that dimension to the control [through a wireless connection],” Tojdowski said. “The data can be coordinated with SPC information, and the offsets are automatically made through the control’s application programming interface.” The wireless system increases speed and accuracy and removes the human factor, he said. In conjunction with the control technology, Okuma also offers its MacMan-Net system, which uses Ethernet capabilities in the control to collect and record operating data in real time. Performance parameters, machine operating conditions and maintenance information are available off the shop floor, on demand. “Features like that help a shop run more efficiently, improve their quality and reduce costs,” Tojdowski said.

Adding Value

Rick Doerr, vice president of sales and marketing for Amera Seiki Inc., Cedar Rapids, Iowa, said attracting buyers in such a competitive atmosphere can’t depend on prices alone. “You can only go so far with pricing before it becomes unprofitable,” he said. According to Doerr, selling machines requires adding value above and beyond hardware considerations, in the form of services, warranties and options. Services can include runoffs, programming assistance and inspections. “We are working on a program to offer a 12-month basic checkup before the warranty is over,” he said as an example.

Courtesy of Okuma

Efficient data management can help a shop improve productivity and reduce costs. Okuma’s OSP-P200 THINC control provides a variety of data collection and management capabilities, including wireless processing of gauging information and automatic setting of offsets through the control’s application programming interface.

Doerr said many machine shoppers are seeking additional features that will enable them to service a broader base of customers. A typical feature would be part probing, with the goal of minimizing inspection cost. A circular interpolation feature, paired with special tools, can permit hobbing on a VMC.

“For a casting that requires an internal spline, a shop can buy tools and use circular interpolation to put in that spline right on the VMC instead of sending it out and having it broached,” Doerr said. At the time of purchase, it is relatively inexpensive for a machine tool builder to add control options such as high-speed program checks, polar coordinate interpolation and tool life management. In many respects, Doerr said, the machine tool business is just like the automotive business. “You can only go so far with prices, but you can offer options and throw in longer warranties,” he said.

A Cyclical Business

Manufacturing has always been a cyclical business. Driven by global competition, instant electronic communication and financial excesses bordering on insanity and criminal behavior, the cycle this time has descended from frothy highs to seemingly unprecedented lows. Nevertheless, machine tool builders and their customers are responding in positive ways that should create a foundation for the next trip upward. CTE

About the Author: Bill Kennedy, based in Latrobe, Pa., is contributing editor for Cutting Tool Engineering. He has an extensive background as a technical writer. Contact him at (724) 537-6182 or at billk@jwr.com.

Methodical financing

Most machine tool companies will work with their customers to enable them to purchase new equipment, either directly or through distributors and finance houses. Scott McIver of Methods Machine Tools said his company has its own in-house financing arm, including a selection of financing vehicles tailored to different organizations, including large companies, fast-growing facilities and startups.

Obtaining financing generally is not difficult if the company has stable credit. “Most companies that are profitable and have been in business for a few years receive a quick approval,” said McIver. However, he admitted, “it certainly is a shrinking credit market right now; getting financing for guys who probably shouldn’t be buying machine tools is getting harder. You watch the homebuyer credit crunch, and it’s similar. Some shops should not have been buying machines and adding capability and they were. Some of the more price-based machine tool suppliers were dropping machines off at shops that maybe owed the IRS money. That’s going to come back and get them. We are a conservative company, so our analysis of ratios and debt coverage are conservative.”

—B. Kennedy

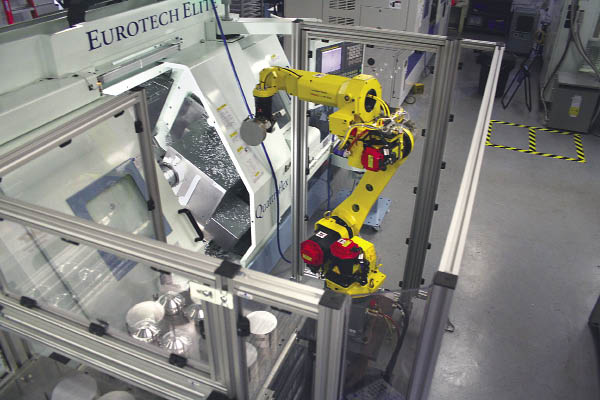

Courtesy of Chasco Machine & Manufacturing

Multispindle Eurotech machine tools permit Chasco Machine & Manufacturing to use one machine to produce parts that otherwise would require secondary operations, while a Fanuc robot permits low-cost, untended work.

Navigating 'this mess' of an economy

Jeff Roth, founder of Chasco Machine& Manufacturing, Port Richey, Fla., described current economic conditions as “this mess.” He said his accountant told him, “If you end up breaking even this year, you’ll be a winner.” Chasco will do much better than that, but not without significant effort and continued application of advanced machine tool technology.

Roth, a 20-year veteran of the machine shop business, formed Chasco in 2000. The company services the aerospace, energy and other industries, machining parts as small as ¹⁄8 " in diameter and as large as 6 " to 10 " in diameter to tolerances of 0.0005 " and tighter. Most parts are made from 4340 steel and aluminum; lot sizes are generally 100 to 250 pieces but can be as large as 50,000. “We try to get the customer to give us their annual usages; then we can run them in a Kanban system,” Roth said. “That gives us the flexibility to keep our machines running all the time.”

Roth said the economic slowdown hit his operation suddenly and was compounded by the mechanics strike at Boeing, which buys products from Chasco’s customers. Before that happened, “We had such a boom it was like heroin. I knew in the back of my head it wasn’t going to last forever, though.” In February 2008 the shop shipped about $350,000 worth of products to five different customers; this past February it shipped about $210,000. However, Roth said, “We are slowly becoming a better company than we were last year. We shipped to 11 different customers; oil patch work has definitely picked up, and we’ve added aerospace companies too.”

The one thing that “saved our butt” amidst the economic turmoil, Roth said, was the shop’s machine tools. Chasco has Elite multispindle lathes from Eurotech, Brooksville, Fla.; Tsugami Swiss-style automatic lathes imported by REM Sales, Windsor, Conn.; and is adding Lico CNC turning centers, supplied by Eurotech. A Fanuc robot permits untended operation. The multispindle machines enable Chasco to use one machine to produce parts that otherwise would require secondary operations, and the robot permits low-cost, untended work.

The shop’s newest Eurotech machine features a subspindle and has Y-axis capability on both of its twin turrets. “We have a customer coming in for a steel carrier for the AR-15 rifle. It’s 1,000 pieces a month, and the new machine is perfect for it,” Roth said. “We can take that part and run it complete on our lathe and be milling on two sides at the same time. Then we are going to send it out for heat treat; instead of grinding the 0.001 " tolerance on the OD after heat treat, we are going to hard turn it in our Eurotech with the robot on it.”

Roth noted that current economic conditions make it hard for shops to step up to new technology. “Let’s say a guy has four or five people in his shop, a common small shop,” he said. “They don’t set the world on fire, the payroll is decent. If they buy a 2-axis lathe and a little milling center with an indexer, they are not going to be competitive. But if they want to get a $350,000 machine they are going to have a hard time getting someone to lease that to them. The banks have got to look at this differently. This is where, I hate to say this, the government has to get involved with backing some of these leases. It doesn’t help us to hire more people in this trade if we’re not competitive. That’s gotta change.”

—B. Kennedy

Contributors

Amera Seiki Inc.

(319) 730-0310

www.amera-seiki.com

Chasco Machine & Manufacturing

(727) 815-3510

www.chascomachine.com

Eurotech

(352) 799-5223

www.eurotechelite.com

Haas Automation Inc.

(800) 331-6746

www.haascnc.com

Methods Machine Tools Inc.

(978) 443-5388

www.methodsmachine.com

Mori-Seiki U.S.A. Inc.

(847) 593-5400

www.moriseiki.com

Okuma America

(704) 588-7000

www.okuma.com

Related Glossary Terms

- alloys

alloys

Substances having metallic properties and being composed of two or more chemical elements of which at least one is a metal.

- backing

backing

1. Flexible portion of a bandsaw blade. 2. Support material behind the cutting edge of a tool. 3. Base material for coated abrasives.

- centers

centers

Cone-shaped pins that support a workpiece by one or two ends during machining. The centers fit into holes drilled in the workpiece ends. Centers that turn with the workpiece are called “live” centers; those that do not are called “dead” centers.

- computer numerical control ( CNC)

computer numerical control ( CNC)

Microprocessor-based controller dedicated to a machine tool that permits the creation or modification of parts. Programmed numerical control activates the machine’s servos and spindle drives and controls the various machining operations. See DNC, direct numerical control; NC, numerical control.

- endmill

endmill

Milling cutter held by its shank that cuts on its periphery and, if so configured, on its free end. Takes a variety of shapes (single- and double-end, roughing, ballnose and cup-end) and sizes (stub, medium, long and extra-long). Also comes with differing numbers of flutes.

- gang cutting ( milling)

gang cutting ( milling)

Machining with several cutters mounted on a single arbor, generally for simultaneous cutting.

- grinding

grinding

Machining operation in which material is removed from the workpiece by a powered abrasive wheel, stone, belt, paste, sheet, compound, slurry, etc. Takes various forms: surface grinding (creates flat and/or squared surfaces); cylindrical grinding (for external cylindrical and tapered shapes, fillets, undercuts, etc.); centerless grinding; chamfering; thread and form grinding; tool and cutter grinding; offhand grinding; lapping and polishing (grinding with extremely fine grits to create ultrasmooth surfaces); honing; and disc grinding.

- interpolation

interpolation

Process of generating a sufficient number of positioning commands for the servomotors driving the machine tool so the path of the tool closely approximates the ideal path. See CNC, computer numerical control; NC, numerical control.

- lathe

lathe

Turning machine capable of sawing, milling, grinding, gear-cutting, drilling, reaming, boring, threading, facing, chamfering, grooving, knurling, spinning, parting, necking, taper-cutting, and cam- and eccentric-cutting, as well as step- and straight-turning. Comes in a variety of forms, ranging from manual to semiautomatic to fully automatic, with major types being engine lathes, turning and contouring lathes, turret lathes and numerical-control lathes. The engine lathe consists of a headstock and spindle, tailstock, bed, carriage (complete with apron) and cross slides. Features include gear- (speed) and feed-selector levers, toolpost, compound rest, lead screw and reversing lead screw, threading dial and rapid-traverse lever. Special lathe types include through-the-spindle, camshaft and crankshaft, brake drum and rotor, spinning and gun-barrel machines. Toolroom and bench lathes are used for precision work; the former for tool-and-die work and similar tasks, the latter for small workpieces (instruments, watches), normally without a power feed. Models are typically designated according to their “swing,” or the largest-diameter workpiece that can be rotated; bed length, or the distance between centers; and horsepower generated. See turning machine.

- lean manufacturing

lean manufacturing

Companywide culture of continuous improvement, waste reduction and minimal inventory as practiced by individuals in every aspect of the business.

- milling

milling

Machining operation in which metal or other material is removed by applying power to a rotating cutter. In vertical milling, the cutting tool is mounted vertically on the spindle. In horizontal milling, the cutting tool is mounted horizontally, either directly on the spindle or on an arbor. Horizontal milling is further broken down into conventional milling, where the cutter rotates opposite the direction of feed, or “up” into the workpiece; and climb milling, where the cutter rotates in the direction of feed, or “down” into the workpiece. Milling operations include plane or surface milling, endmilling, facemilling, angle milling, form milling and profiling.

- outer diameter ( OD)

outer diameter ( OD)

Dimension that defines the exterior diameter of a cylindrical or round part. See ID, inner diameter.

- statistical process control ( SPC)

statistical process control ( SPC)

Statistical techniques to measure and analyze the extent to which a process deviates from a set standard.

- tapping

tapping

Machining operation in which a tap, with teeth on its periphery, cuts internal threads in a predrilled hole having a smaller diameter than the tap diameter. Threads are formed by a combined rotary and axial-relative motion between tap and workpiece. See tap.

- tolerance

tolerance

Minimum and maximum amount a workpiece dimension is allowed to vary from a set standard and still be acceptable.

- turning

turning

Workpiece is held in a chuck, mounted on a face plate or secured between centers and rotated while a cutting tool, normally a single-point tool, is fed into it along its periphery or across its end or face. Takes the form of straight turning (cutting along the periphery of the workpiece); taper turning (creating a taper); step turning (turning different-size diameters on the same work); chamfering (beveling an edge or shoulder); facing (cutting on an end); turning threads (usually external but can be internal); roughing (high-volume metal removal); and finishing (final light cuts). Performed on lathes, turning centers, chucking machines, automatic screw machines and similar machines.