Global machine tool business set to gain momentum

Global machine tool business set to gain momentum

Economic pundits anticipate global machine tool consumption will increase 2.1 percent in 2017, reaching a market value of $73.6 billion, according to the German Machine Tool Builders' Association, Frankfurt am Main, Germany. The group released the machine tool business data at a March 9 press conference in Chicago for the EMO trade show, which takes place Sept. 18 through Sept. 23 in Hanover, Germany.

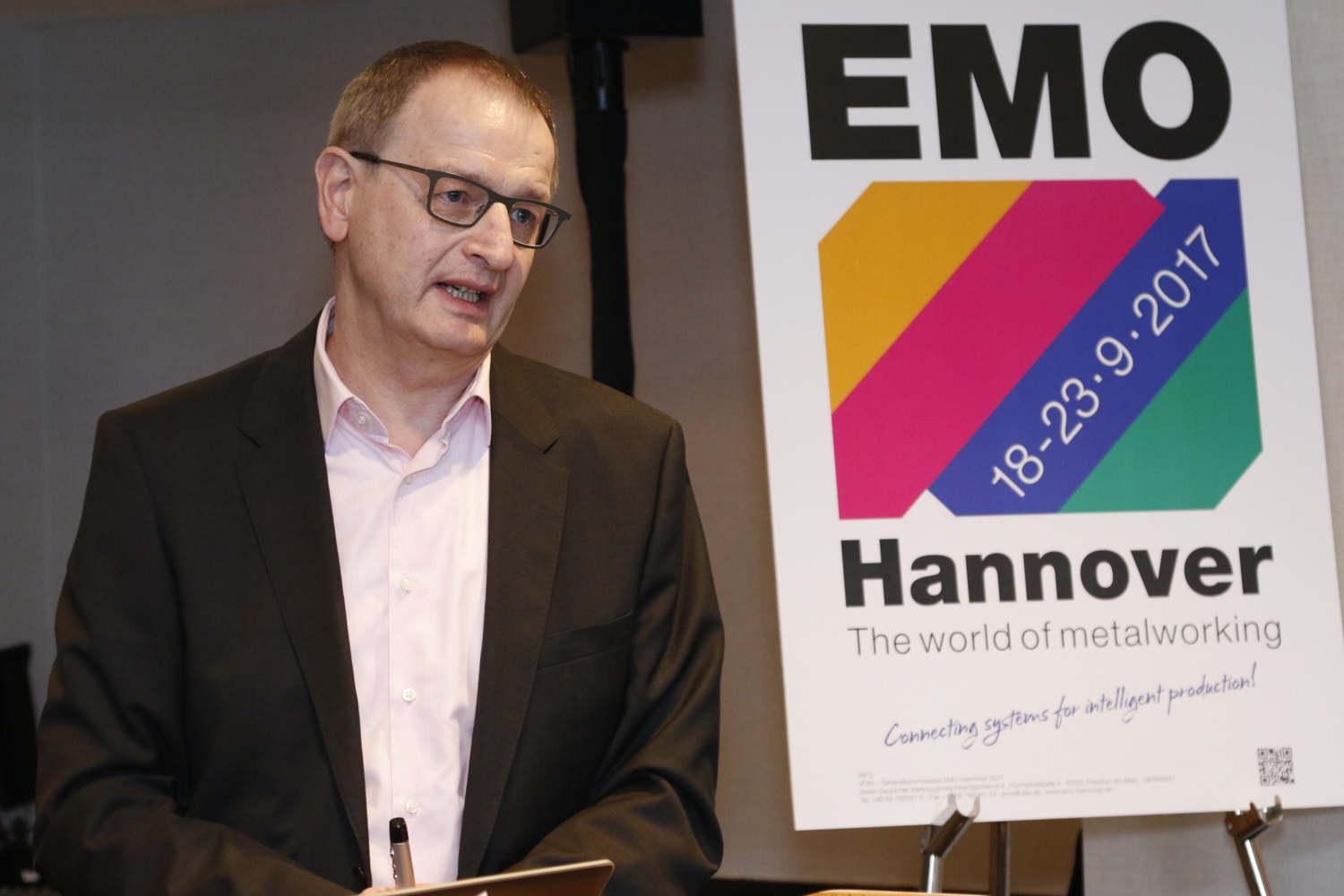

Economic pundits are anticipating global machine tool consumption to increase 2.1 percent in 2017, reaching a market value of $73.6 billion, noted Dr. Wilfried Schäfer (pictured), executive director of VDW (German Machine Tool Builders' Association), Frankfurt am Main, Germany. He presented information about the machine tool business at a March 9 press conference in Chicago for the EMO trade show, which takes place Sept. 18–23 in Hanover, Germany.

This compares with a fall of 1.7 percent in 2016, when global machine tool consumption was $72.2 billion, estimated the British research institute Oxford Economics, VDW's forecasting partner. VDW forecasts that Asian and American countries can achieve only a below-trend rise in their machine tool consumption during 2017, of 1.7 and 0.9 percent, respectively, but that's an improvement compared to an estimated drop in 2016 of -3.6 percent for Asia and -3.8 percent for America.

Despite the continual uptrend for the overall U.S. economy, the nation's industrial investment activity is sluggish, in part because large sectors like mining and oil and gas production are in a consolidation phase, according to Berlin-based economic development agency Germany Trade & Invest (GTAI).

The automotive industry, however, is doing well. According to Oxford Economics, the industry will increase its capital investment by 1.0 percent this year. Technologies for reducing fuel consumption and lightweight components are in demand, with the focus on machining aluminum, stacked lightweight materials and composites. Lightweighting also applies to aircraft manufacturers; they plan to invest 5.6 percent more in 2017.

Looking at the latest actual results, the U.S. imported more than 60 percent of its machine tool consumption in 2015, totaling about $8 billion. With a share of 16.5 percent, Germany was the second main supplier of those machines, with Japan supplying 33.9 percent.

"The German machine tool industry is very well anchored among the major American automakers, their component suppliers, the aviation industry and the mechanical engineering sector," Schäfer stated. "We also, however, want to encourage the numerous mid-tier and relatively small users of machine tools to find out at EMO Hannover what else the world of metalworking has to offer."

At the press conference, David Koepp, president and CEO of Roscoe, Ill.-headquartered All World Machinery Supply, spoke about the benefits of attending EMO. He emphasized the scope of machines and other metalworking products exhibited at the trade fair. "It's the largest that I've seen."

Koepp added that attendees are able to interact with the owners and presidents of companies that manufacture production equipment and tools, as well as engineers, and generate "real business" and gather useful ideas and solutions instead of a stack of business cards. "The engineering flair is impressive," he said. "You get a look at where manufacturing is heading."

Although U.S. manufacturers may question why they should spend the time and money to travel to Hanover for a trade show, Larry Turner, president and CEO of Hannover Fairs USA, Chicago, said exhibitors frequently use EMO to launch the latest manufacturing technologies. When the biennial event was previously in Germany in 2013 (the show was held in Milan, Italy in 2015), 45 percent of the exhibitors presented new innovations, according to show organizers. The 2013 show drew 1,100 U.S. attendees.

"It's a different show culture," Turner said. "It's hard to describe unless you've been there."

Because the show is quite large, with 1,889 applications for 521,250 sq. ft. of exhibit space as of press time, Turner recommends that a company should send more than one person to adequately cover it.

For more information about EMO Hannover, visit www.emo-hannover.com.