Massive order backlogs drive growth in the linear motion market

Massive order backlogs drive growth in the linear motion market

Global revenues for linear motion products reached a record high of $7.9 billion in 2017. Revenue growth of 10.2 percent is expected in 2018, primarily due to substantial order backlogs. Growth will then slow to 4.5 percent in 2019. Due to improved global economic conditions and an increase in manufacturing activity, total revenue from linear motion products is forecast to grow at a compound annual growth rate (CAGR) of 5.6 percent from 2017 to 2022.

By Syed Mohsin Ali, research analyst, industrial automation, IHS Markit

- Global revenues for linear motion products reached a record high of $7.9 billion in 2017. Revenue growth of 10.2 percent is expected in 2018, primarily due to substantial order backlogs. Growth will then slow to 4.5 percent in 2019. Because of improved global economic conditions and an increase in manufacturing activity, total revenue from linear motion products is forecast to grow at a compound annual growth rate (CAGR) of 5.6 percent from 2017 to 2022.

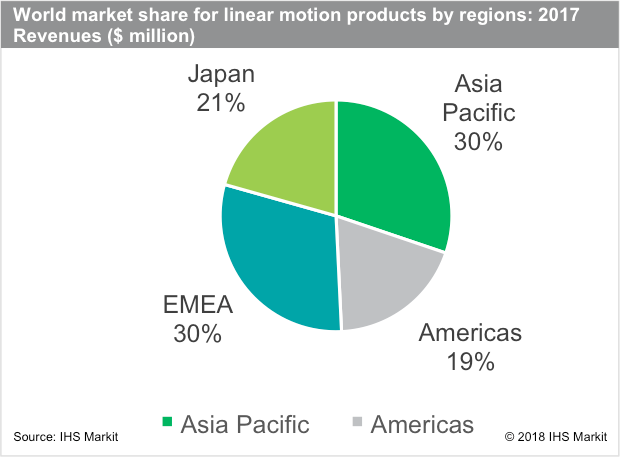

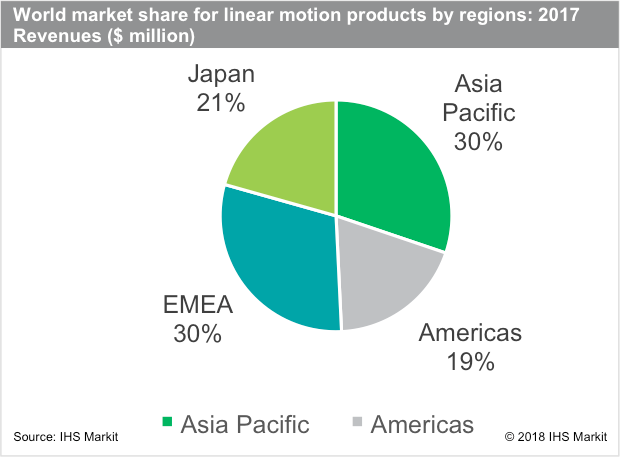

- From 2016 to 2017, the linear motion products market in Europe, Middle East and Africa (EMEA) increased by 13.4 percent, the Asia-Pacific market increased by 24.3 percent, the American market grew by 12.6 percent and the Japanese market increased 9.4 percent.

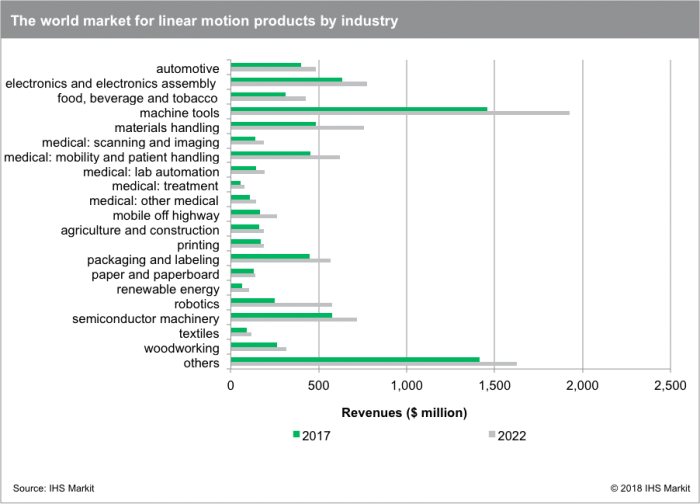

- The two largest industries for linear motion products in 2017 were machine tools and medical and scientific. Machine tools accounted for 18.4 percent of global revenues, followed by medical at 11.2 percent. Robotics is forecast to be the fastest-growing market for linear motion products, with an 18.1 percent revenue CAGR from 2017 to 2022.

- Revenues from assembled actuator products, primarily commercial-grade rod-style and rodless actuators, are projected to grow at a CAGR of 5.7 percent from 2017 to 2022, which is the highest growth rate of all complete product types. This growth rate is slightly higher than the projected 5.5 percent CAGR for ball screws and the 5.6 percent CAGR for linear guides.

The analysis

The era of double-digit growth in the linear motion products market is coming to an end, with the market about to enter a period of stable growth as demand begins to ease down. A substantial surge in demand for linear motion products, originating in the last quarter of 2016, continued into 2017 and led to record revenue growth for the industry. However, linear motion product manufacturers were not expecting this situation and were not adequately prepared to deal with it, which has led to a considerable increase in delivery times--from a couple of weeks for some products, to as much as half a year for products like linear guides and ballscrews.

Companies are now struggling to acquire mild steel, medium carbon steel, aluminum, stainless steel and other raw materials. High demand from automotive, factory automation and other metal-intensive industries means producers of these metals are fully booked, until the last quarter of 2018, and will be unable to accommodate for increased demand from linear motion products. This dearth of raw materials is likely to ease up during the fourth quarter of 2018, as demand slows down. The linear motion market is expected to enter an age of stable growth from 2019 onward, as demand for linear motion products returns to more sustainable levels.

There is a growing fear the market could experience a large-scale price war between the big players in 2109, which seems likely, since it has already begun in some markets in Europe. For example, in Italy THK and HIWIN are vying to lead the market, which has pushed out other competitors. In the long term, it is likely that profit margins will be reduced and overall revenue growth restricted, limiting the growth potential of the market.

The comparatively lower growth rates for assembled actuator products--primarily commercial-grade rod-style and rodless actuators--is due to is their dependence on capital-intensive machinery investments in the automotive, food and beverage, packaging, materials handling, machine tools and electronics assembly industries.

An increase in demand for gantry machinery will drive demand for linear motion products in robotics, especially for pick-and-place applications. Most of this demand stems from China's increased adoption of advanced automation solutions, including robotics.

The annual Linear Motion Intelligence Service from IHS Markit investigates the size and growth of the linear motion products market, providing base-year data for 2017 and forecasting growth through 2022. In addition, numerous market segmentations are provided, including industry sector, geographic region and product size. The study also provides a qualitative analysis of product trends, growth drivers and an overview of the competitive environment, including market shares by product type for each major geographic region.