Article from Persistence Market Research

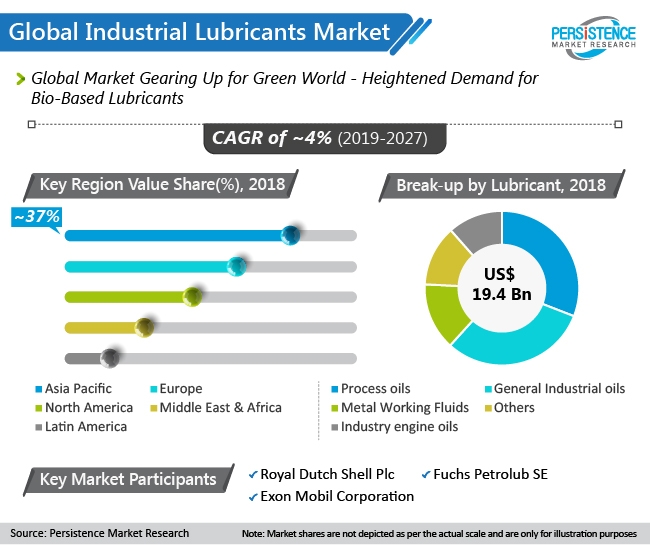

Enhanced operational efficiency offered by industrial lubricants is bolstering their use in the constantly expanding manufacturing sector, as well as other industries such as power generation and oil and gas. Growing use of high-performance lubricants in these end-use industries is expected to drive market growth in the forecast period (2019-2027). As indicated by a new study, the global demand for industrial lubricants will progress moderately through 2027, reaching a value of US$ 28 Bn.

Key Takeaways - Edible Oils Market Study

- Growing use of complex machinery and tools in industries is increasing the demand for general industrial oils, making it a prominent segment in the global industrial lubricants market.

- The global market is witnessing a gradual shift towards bio-based industrial lubricants. In addition to the environmental advantages, bio-based industrial lubricants provide better lubrication and superior viscosity.

- Customers in the manufacturing industry are seeking to increase output efficiency by minimizing downtime and boosting productivity, resulting in sustained demand growth for industrial lubricants.

- Manufacturers are focused on sustainability measures such as recycling and reuse of industrial lubricants. Lubricant manufacturers are providing on-site and off-site lubricant recycling equipment and services to their customers.

- Asia Pacific commands a prominent share in the global industrial lubricants market owing to significant growth in the manufacturing industry and increasing oil and gas operations in the region.

With the use of specialty additives, companies are focused on providing industrial lubricants with better efficiency. Growing environmental concerns are turning the focus of the lubricant industry towards the development of bio-based lubricants, which are estimated to gain more consumer preference in the coming years.

How is Market Structure Defined?

Key players are expanding their global presence by investing in organic growth and practicing integration across the value chain to reduce production costs. For example, Exon Mobil Corp. completed the expansion of its Singapore refinery to upgrade the production of Group II base stock and enhance its integrated competitiveness.

Companies are emphasizing on providing high-grade industrial lubricants and custom product solutions to boost their unique selling proposition and competitive position. Key players in the global industrial lubricants market include Royal Dutch Shell plc and Exon Mobil.

Tough Competition Among Manufacturers

In the coming years, industrial lubricants are expected to witness consistent demand. With the persistent trend of providing application-specific lubricants, manufacturers are focused on keeping their product portfolios strong. Asia Pacific remains the most lucrative region in the global market with a prominent value-volume share, while the Middle East and Africa is estimated to witness high CAGR. With increasing demand, key players are expanding their presence through strategic acquisitions and leveraging distributors to penetrate target regions.

Related Glossary Terms

- turning

turning

Workpiece is held in a chuck, mounted on a face plate or secured between centers and rotated while a cutting tool, normally a single-point tool, is fed into it along its periphery or across its end or face. Takes the form of straight turning (cutting along the periphery of the workpiece); taper turning (creating a taper); step turning (turning different-size diameters on the same work); chamfering (beveling an edge or shoulder); facing (cutting on an end); turning threads (usually external but can be internal); roughing (high-volume metal removal); and finishing (final light cuts). Performed on lathes, turning centers, chucking machines, automatic screw machines and similar machines.