Hot stuff: U.S. energy market in overdrive as shale drilling booms

Hot stuff: U.S. energy market in overdrive as shale drilling booms

In 2013, the U.S. passed Russia as the world's leading producer of oil and gas and became a net oil exporter for the first time in decades -- all thanks to shale.

Even though the GOP ticket didn't win the 2008 election, U.S. energy companies have heeded vice presidential candidate Sarah Palin's admonition to "drill, baby, drill." They've drilled so much that in 2013, the U.S. passed Russia as the world's leading producer of oil and gas and became a net oil exporter for the first time in decades. This turnaround can be summed up in one word: shale.

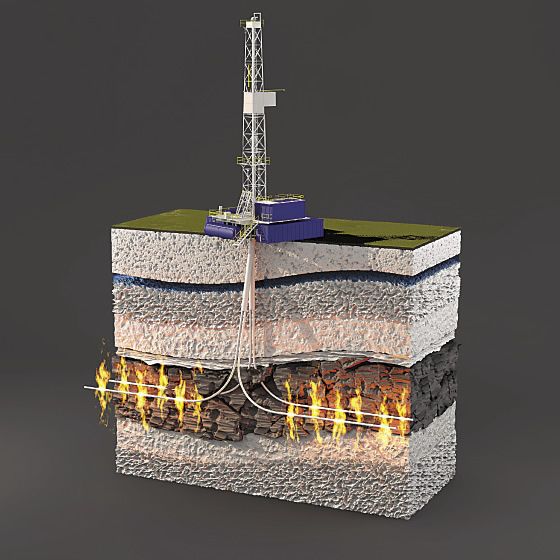

Hydraulic fracturing, or fracking, in U.S. shale reserves has liberated vast amounts of oil and natural gas, providing a major boost to the U.S. economy and creating big opportunities for suppliers that serve the oil and gas industry, including machine shops and other part manufacturers.

Big Numbers

The numbers behind the shale boom are staggering. According to the U.S. Energy Information Administration, the U.S. has proven reserves of about 1,161 trillion cu. ft. (tcf) of natural gas, said Tanya Bodell, executive director of Boston energy consulting firm Energyzt during a presentation at the AMT Global Forecasting & Marketing Conference, held Oct. 14-16 in Cincinnati. "The U.S. uses about 25 tcf a year, which means we have about 45 to 48 years worth of gas in reserve," she said. "But that's just the tip of the iceberg. Underneath those reserves it's estimated that we have about four times as much gas, which would mean there is 200 years' worth of gas at our current usage levels."

Investments being made to extract that gas are staggering as well. Englewood, Colo.-headquartered consultancy IHS Global Insight projects $3.2 trillion in total investment in the U.S. shale gas industry through 2035, which includes drilling, well completion, facilities and infrastructure capital expenditures.

The Marcellus shale play is representative of the industry. It is a large reserve located mainly in Pennsylvania and New York, but being drilled primarily in Pennsylvania because New York has in place a moratorium on drilling. According to reports by energy companies to the Pennsylvania Department of Environmental Protection, shale gas production in the Marcellus region increased to 3.1 tcf in 2013 from 1.6 tcf in 2012 and 1 tcf in 2011. The Marcellus will account for 25 percent of U.S. natural gas production by 2015, according to Morningstar Inc., Chicago, an investment research company. Total U.S. natural gas production is expected to increase by 4 percent this year and next.

Metalworking Opportunities

Part manufacturers will likely have a long-term opportunity to make components for fracking operations. In addition to drilling heads and assemblies, high-pressure fracking pumps require specialty machined parts, including ring groove seals, connectors, crosses, adapters, spools, pull plugs and ball droppers.

The drive to make fracking shale deposits and transporting natural gas safer and more environmentally acceptable will also propel demand for specialty parts. For example, the need for devices that monitor leaks and other drilling problems will grow, according the The Kiplinger Report. To help meet that demand, GE Energy makes "pigs," devices that check pipeline interiors for cracks and other issues. Also, a boom in pipeline construction is expected to relieve some of the volume of oil increasingly being carried by trains and trucks, which should reduce the environmental impact of transportation. All told, about 10,000 miles of new pipelines will be laid this year, with more to come, according to Kiplinger.

In fracking, a well is drilled thousands of feet vertically into the ground and then horizontally into shale deposits. Explosive charges then perforate the well casing to put cracks in the shale. A water, sand and chemical mixture are then pumped, at high pressure, into wells to expand the fissures and enable oil and gas to pass through them. As the mixture is pumped out of the well, the oil and gas follows the pipeline to the wellhead on the surface.

Demand for reinforced railroad tanker cars to transport oil and natural gas liquids (NGLs), specifically propane and ethane, more safely is growing—particular after recent catastrophic tanker accidents in Quebec and North Dakota. One tank car maker, The Greenbrier Cos., is designing a new, safer tanker and studying how to strengthen existing cars through retrofits. Oil and gas firms may buy as many as 60,000 new cars in coming years, according to Kiplinger.

Also, manufacturers are investing in machine tools and accessories to make energy parts. About 10 percent of total U.S. manufacturing technology orders of $5.7 billion in 2012 went into energy parts manufacturing, according to AMT—The Association For Manufacturing Technology.

Plentiful and Cheap

The shale drilling boom has kept natural gas plentiful and relatively cheap in the U.S. For example, natural gas costs more than three times as much in China, France and Germany than in the U.S. and nearly four times as much in Japan.

However, the U.S. natural gas market has experienced major price spikes. In the 1990s, U.S. prices averaged about $2 per million Btu, according to figures from the American Petroleum Institute. In 2001, prices spiked above $8 mBtu, but returned to about $2 per mBtu in 2002. Prices began rising again, spiking close to $14 per mBtu in 2006 and $13 per mBtu in 2008, caused by unusually cold winter weather and growing demand from electrical power producers that had displaced coal-fired generating stations with natural gas ones. However, large increases in the natural gas supply dropped the price back to a range from $2 to $4 per mBtu from 2009 to 2013 as a result of shale production. Price spikes are now localized, created by pipeline constraints from legacy infrastructure that was not built to connect current shale sources to sinks, according to Bodell.

Abundant natural gas has changed the U.S. commercial electricity industry, which has gone from producing about 18 percent of its power from natural gas in the 1990s to about 30 percent in 2012. Natural gas reached parity with coal as an energy source for electricity the first time in April 2012, according to Bodell.

"Whereas electricity prices traditionally have been set by the price of natural gas, the price of natural gas now is being set to elicit the required demand from the electricity industry," she said.

Another major demand driver for natural gas is the U.S. petrochemical industry, which relies on propane and ethane to produce plastics and chemicals, respectively. Propane and ethane, processed via "cracking" into propylene and ethanol, are present in oil and certain natural gas deposits. While "dry" natural gas contains little of these NGLs, "wet" natural gas, like that found in the Marcellus shale play, has NGLs in abundance.

"While dry gas has gone down in price, making it less economic to explore and extract, drilling for wet gas is still attractive because of the price of the NGLs," Bodell said. "As a result, the U.S. has gone from being an importer to an exporter of petrochemical feedstocks." The change has been so profound that domestic and foreign companies are building large petrochemical plants near key shale fields in the U.S.

Export or Not?

One of the key policy issues involving U.S. natural gas is whether or not to export it. Currently, there are no significant export terminals for natural gas in the U.S. However, large price disparities between U.S. and foreign natural gas make it economically feasible for U.S. suppliers to export.

"The U.S. natural gas industry is advocating for the ability to export," Bodell said. "Overseas prices in the high teens will be more than enough to cover the price of transportation—especially with the recent expansion of the Panama Canal."

She calls the coming debate between natural gas producers and petrochemical companies "the fight of the century," with each group touting the economic benefits accruing to its side. Natural gas producers argue that export markets will boost jobs in natural gas production. The petrochemical industry counters that exports will increase the price of natural gas in the U.S. and the economy is better served by access to low-cost gas that will produce more jobs than in the natural gas industry as petrochemical companies build plants to exploit it.

The American Chemistry Council, which represents petrochemical producers, projects investment through 2020 of $71.7 billion in petrochemical plants, creating about 485,000 incremental jobs in construction and 300,000 permanent payroll positions by 2020.

Energy markets and factors that could increase natural gas prices. It is likely that the impact of natural gas price fluctuations in the U.S. will be regional.

Despite the petrochemical industry's opposition, natural gas exports from the U.S. are scheduled to begin entering world markets in 2018, according to Bodell. Already, the U.S. Department of Energy has approved six natural gas export terminals, out of 25 proposed sites, in the following locations: Lake Charles, La.; Sabine Pass, La.; Cameron, La.; Cove Point, Md.; and two in Freeport, Texas (on Quintana Island). "The Cove Point approval in particular is very significant because it's the first terminal closely situated to the Marcellus shale," Bodell said.

Russia's recent invasion of Ukraine may also help make exports more likely. Russia is a principal supplier of natural gas to Europe and there is concern that Russia will use it as a political weapon if there is an extended period of tension between Russia and Western countries over Russia's occupation and annexation of Ukrainian territory. Robust exports to the European Union would blunt that weapon.

Too Much to Ask?

One of the big questions about U.S. shale drilling is if it is a bubble that will burst or a long-term economic engine. "The naysayers argue that we're expecting too much from shale gas—everything from providing energy security to reducing energy costs to decreasing the deficit. They say [the boom] can't last," Bodell said.

However, there are indicators that the U.S. shale boom could be long lasting. For example, while large shale plays exist in other parts of the world, it will take many years before other nations begin large-scale recovery of shale gas, according to a February report by the Boston Consulting Group (BCG). "In Europe, there is major environmental opposition to fracking and they have very limited water supplies, which are vital for the process," Bodell said. "There is an outright ban on fracking in France.

"In the U.S., we have infrastructure already in place and ownership of mineral rights, both of which are conducive to development," Bodell continued. U.S. property owners own the mineral rights to their land, which can be freely bought and sold. In most of Europe, however, the government owns mineral rights on all land, including private property, making it much more difficult for development to begin.

Also, in the U.S. there is a liquid market for drilling rigs, which can be moved quickly to new locations, and a network of natural gas pipelines—with more being built—to transport the gas. "The U.S. has first-mover advantage in this market and we are well ahead of the rest of the world," Bodell said.

The U.S. natural gas industry is likely to continue its strong growth for many years, a trend that will help U.S. manufacturers. The BCG report stated cheap natural gas will have a greater impact on U.S. manufacturing over the next several years than is commonly assumed, giving the U.S. a powerful cost advantage that will benefit a range of industries, from feedstocks to finished goods. This cost advantage has already started to boost investment and employment and will persist for at least 5 years, according the study.

"Several major forces are aligning right now that are dramatically reversing the fortunes of a U.S. manufacturing sector that many gave up for dead just a few years ago," said Harold Sirkin, a BCG senior partner and a co-author of the study. "The energy advantage and improved competitiveness are unique to the U.S. and are accelerating an American manufacturing renaissance." CTE