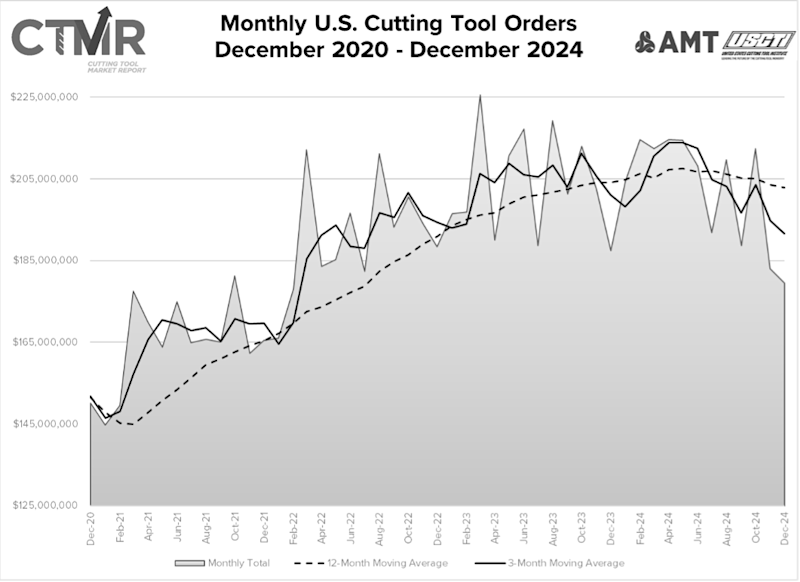

Shipments of cutting tools, measured by the Cutting Tool Market Report compiled in a collaboration between AMT – The Association For Manufacturing Technology and the U.S. Cutting Tool Institute (USCTI), totaled $179.5 million in December 2024.

Orders decreased 2% from November 2024 and were down 4.3% from December 2023. Shipments totaled $2.43 billion for 2024, down 0.6% from shipments made in 2023. The year-to-date growth rate declined every month in 2024 beginning in April.

“Our industry continued to feel the effects of a stagnated aerospace market as we ended 2024, and this sets us up for a rather uneven first and second quarter,” stated Steve Boyer, president of USCTI. “Cutting tool markets still tended to perform better than other markets through the end of 2024 and start of 2025 but have noticeably softened. Adjusted lower outlooks for this year in the transportation, automotive, aerospace, and defense sectors will project a slower rebound.”

Alan Richter, editor-at-large of Cutting Tool Engineering, added: “With economic and market uncertainties, such as tariffs, supply chains, and inflation, coupled with ongoing and new geopolitical tensions swirling with the election of a new U.S. presidential administration, manufacturers that use cutting tools continued to decrease their tool consumption in December, albeit at a slower rate than November. However, more encouraging reasons for the slide include toolmakers developing cutters that last longer while running at higher machining parameters, productivity gains with automation and AI, and increased efficiency from implementing advanced, or ‘smart,’ technologies.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process, the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.